In India, women are increasingly recognizing the importance of securing their health and financial well-being but there are still limited options when it comes to women-centric health insurance in India. Thankfully, some health insurance companies are focusing on providing women-centric health insurance plans.

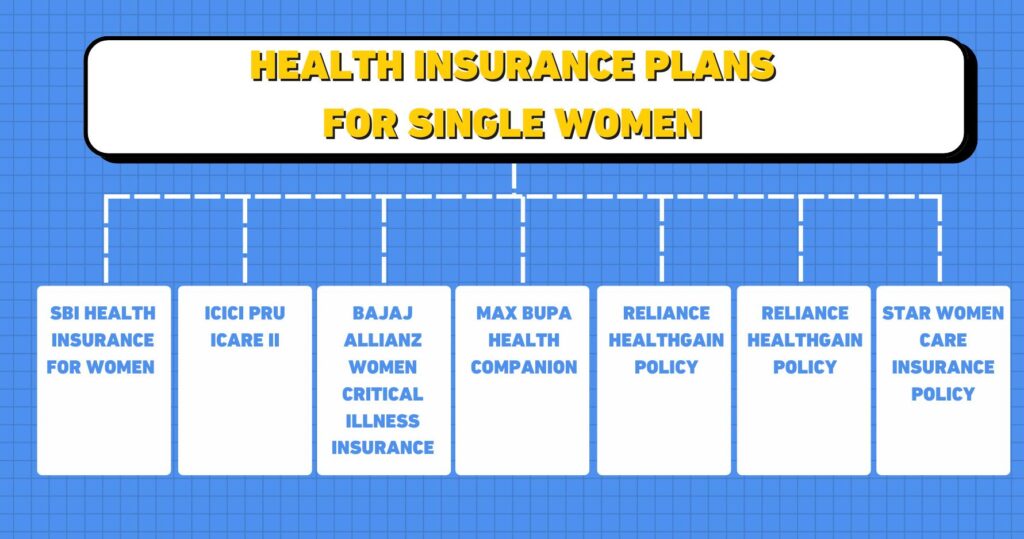

Since modern women in India are navigating various stages of life independently, a comprehensive health insurance plan becomes imperative to safeguard against unforeseen medical expenses. In this article, we delve into 7 health insurance plans specifically tailored to meet the unique needs of single women across the country.

Health Insurance Plans for Single Women

More and more women are considering a health insurance plan to ensure financial security in case of medical emergencies. Here are some health insurance options tailored for single women:

SBI Health Insurance for Women

SBI offers a specialized health insurance plan which is focused on the healthcare needs of modern women. This plan offers a wide range of benefits which includes coverage of hospitalization expenses, maternity benefits, critical illness, and pre-existing conditions.

Through this health insurance plan which is specifically created for women, single women can avail comprehensive coverage tailored to their specific healthcare requirements.

ICICI Pru iCare II

Want a health insurance plan that includes not only health coverage but also critical illness coverage, accidental death benefits, and coverage for terminal illnesses? ICICI got you covered! With this single women’s health plan, you get 2 plan types and tax benefits under Section 80 C. You can opt to pay once or as a regular yearly premium. Check out this women-focused term plan for your protection!

Future Generali Health Powher

It is simply not possible to ignore Future Generali’s offering for women if you are searching for a health plan for modern women. Health Powher brings a solid cover for pregnancy, post-partum, menopause, women-specific critical illnesses, and more. While men can also go for this women-oriented plan, they must add at least 1 female family member to get all the benefits. Last but not least, this is one of the most affordable women’s health plans on our list!

Bajaj Allianz Women Critical Illness Insurance

Bajaj Allianz offers a variety of plans which include specialized critical illness insurance plans for single as well as married women, covering critical illnesses such as breast cancer, cervical cancer, and maternity-related complications. These women’s health plans also provide financial protection to single women against the financial burden of critical illness, ensuring peace of mind during challenging times. This is accomplished through loss of job coverage, child education benefits, and disability benefits.

Max Bupa Health Companion

Max Bupa’s Health Companion plan offers comprehensive coverage for single individuals, including in-patient hospitalization, day-care procedures, pre and post-hospitalization expenses, and maternity benefits. With Max Bupa, single women can avail of comprehensive health coverage to meet their diverse healthcare needs.

Reliance HealthGain Policy

Reliance HealthGain Policy offers health insurance coverage with additional benefits such as maternity coverage, critical illness coverage, and daily cash benefits. While this plan provides financial security to individuals by offering coverage for a wide range of medical expenses, it has special discounts and provisions for girls. For instance, a 5% premium discount for single women and girl children!

Star Women Care Insurance Policy

Star Women Care Insurance Policy is a health insurance plan that offers coverage for hospitalization expenses, pre and post-hospitalization expenses, and maternity benefits. Women planning for motherhood will find a lot of benefits in this policy including assisted reproduction treatment support, ante-natal care, bariatric cover, and cancer cover.

Buying Health Insurance for Single Women: Factors to Consider

When it comes to buying health insurance for single women, a lot needs to be taken into consideration before buying the plan. Here are some major factors:

Coverage Needs: Evaluate and analyze your female healthcare needs, including regular checkups, medications, and any specific treatments or specialist care you might require.

Cost and premium: When choosing a health insurance plan, consider all costs whether it is premiums and out-of-pocket costs such as deductibles, copayments, and coinsurance.

Network of Providers: Give more weightage to insurance providers that are part of your doctor’s network and nearest hospitals. Out-of-network care can be significantly more expensive in some cases.

Prescription Drugs: Review the plan’s formulary (list of covered drugs) to ensure your medications are covered and understand the cost-sharing structure

Preventive Services: It’s advisable to look for single-women plans that cover preventive services like vaccinations, screenings, and annual exams without additional costs

Mental Health and Wellness: Ensure that your women’s health plan provides good coverage for mental health services, including therapy and counseling. A lot of policies don’t cover this.

Maternity and Reproductive Health: If you are planning to conceive in the future, confirm whether your chosen health insurance provider and plan have coverage for maternity care, prenatal visits, and childbirth.

Health Savings Accounts (HSAs): If you opt for a High-Deductible Health Plan, consider opening an HSA. Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

Compare Plans: Girls, it is always beneficial to compare various health insurance plans in India. Use online tools to compare plans based on premiums, deductibles, copayments, and out-of-pocket maximums.

Check Reviews and Ratings: It makes sense to read customer reviews before taking services. Look at customer reviews and ratings for different insurers to get an overview of the quality of service and customer satisfaction.

Buy Health Insurance Plans for Single Women

Choosing the right health insurance plan for women requires careful consideration of your health needs, financial situation, and personal preferences. By evaluating the different types of plans and key factors, you can find a girl health plan that offers the best coverage and value for your individual or family needs.

Do you have any queries about health insurance plans for single women? Please email us at info@aapkapolicywala.com to connect with one of our insurance experts. Feel free to explore our website to buy health insurance plans for your family from our partner insurance providers.

Want to read more? We recommend checking out these blogs too:

8 best pension plans in India

8 health insurance plans for family

How to renew bike or car insurance