Term insurance is crucial to financial planning, providing a significant life cover that helps families to stay financially stable during the event of uncertainties. In India, the demand for term insurance plans has seen a drastic surge after families have realized the importance of financial security.

More and more Indians are recognizing the importance of safeguarding their family’s future by choosing a term insurance plan offered by various public sector giants and private sector companies. But the question arises, Which is the best term insurance company in India to buy a term insurance plan?

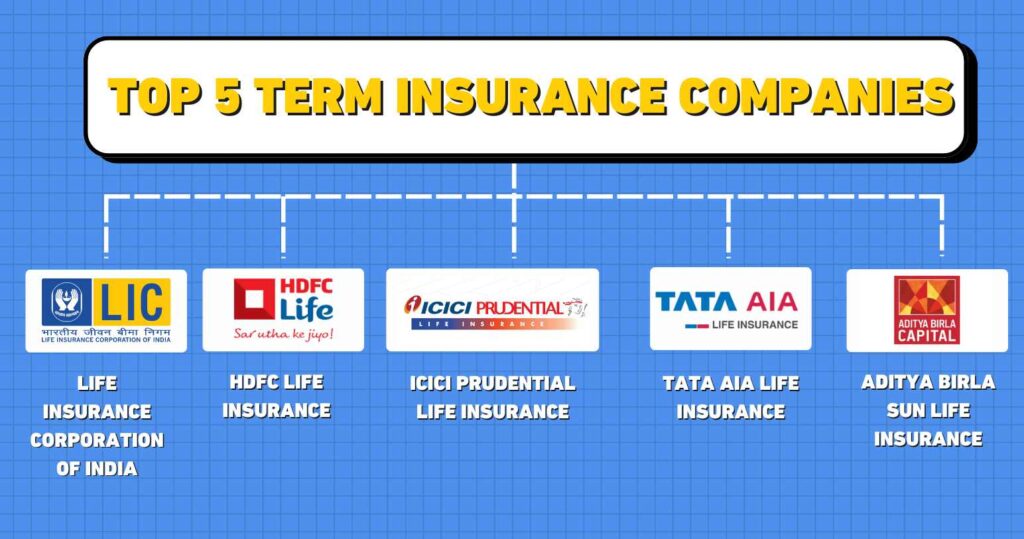

On that note, Aapka Policywala – the leading online insurance company in India – decided to list out the best term insurance companies in India that provide term insurance plans. Through this guide, we aim to navigate you through the myriad of options available, helping you to choose the best term insurance company. Read on!

Life Insurance Corporation of India

Also Known as LIC, Life Insurance Corporation of India is a public sector giant that was established in 1956. Being one of the most trusted providers of term insurance plans in India, LIC has a network of 113 divisional offices & 2048 branches operating all over India.

The term insurance plan offered by LIC brings the tax deduction benefits under Section 80C of the Income Tax Act. Moreover, the term insurance plans at LIC are generally more affordable as compared to other types of life insurance, making it easier to get substantial coverage without straining the family budget.

Life Insurance Corporation of India (LIC) provides affordable and comprehensive term insurance policies catering to the different needs of consumers. In short, they aim to give every Indian access to the best term insurance as per their needs.

HDFC Life Insurance

HDFC Life Insurance stands out as a premier choice for term insurance plans in India due to its customer-centric approach. The term insurance plan from HDFC Life offers protection against accidental death, disability, and 20+ listed critical illness. Whether you are looking for basic protection or a plan with multiple riders to enhance coverage, HDFC Life offers products like HDFC Life Click 2 Protect Life, which allows customization with features and waiver of premium.

With 1-day claim settlement, HDFC Life has consistently worked to improve the claim settlement ratio, which reached above 99% in 2022-2023. This high ratio from HDFC Life ensures that your loved ones receive the financial support they need, without unnecessary delays or complications.

Buy the best individual health insurance in India at an affordable price.

ICICI Prudential Life Insurance

The ICICI Pru iProtect Smart plan offers coverage against 34 listed critical illnesses including heart attack and cancer, making it the best choice for millions of individuals searching for term insurance plans in India. They offer cashless claim services with a 99.17% claim settlement ratio. In short, you can avail of e-opinions if you or your family members are diagnosed with any of the 34 listed critical illnesses. The ICICI Pru iProtect smart plan also offers special rates for women up to 18% lower rates.

Additionally, the availability of online premium payment options and policy

Tracking tools ensure that the policyholder gets a hassle-free experience throughout the journey. By choosing ICICI Prudential for term insurance, you can ensure that the family is financially secure and protected against life’s uncertainties.

Tata AIA Life Insurance

As a joint venture between Tata Sons and AIA Group, Tata AIA combines the legacy of Tata with the international expertise of AIA, offering policyholders a trustworthy term insurance solution in India. This term insurance company offers coverage against 40 listed critical illnesses along with hospitalization benefits. Talking about tax deduction benefits under Section 80C of the Income Tax Act, policyholders can significantly enjoy tax savings of up to 46,800 per annum on their term insurance premiums.

Tata AIA Life Insurance Sampoorna Raksha Supreme plan offers flexibility in choosing the coverage amount and policy term as well as multiple payout options such as lump sum, regular income or a combination of both. The customization ensures that the policyholder gets the best plan that meets their family’s financial requirements and future goals.

Learn everything about critical illness insurance plans in India.

Aditya Birla Sun Life Insurance

Aditya Birla Sun Life Insurance plan offers families up to 1 crore of the sum insured. The term insurance plan at Aditya Birla Sun Life Insurance starts at just 542 per month and covers the death claim due to COVID-19 as well. Term insurance plans such as ABSLI Life Shield Plan offer flexibility in choosing coverage amounts and policy terms. ABSLI offers a range of innovative add-on riders that enhance the coverage of their term insurance plans.

Riders such as critical illness coverage, accidental death, disability benefits, and waiver of premium ensure comprehensive protection against various risks. This flexibility allows policyholders to customize their coverage, providing additional security and peace of mind.

Popular term insurance plans from Aditya Birla Sun Life Insurance are:

- ABSLI Salaried Term Plan

- ABSLI DigiShield Plan

- ABSLI Life Shield Plan

- ABSLI Saral Jeevan Bima Yojna

Term Insurance Companies in India: Wrapup

We hope that the above article helped you learn about the best-term insurance companies in India. Before buying a term insurance plan in India for yourself and your family, make sure to check online reviews and get the sum insured to get the treatment done.

Want to buy a term insurance plan from a reputed company at an affordable price in India?

*Enters Aapka Policywala*

We are one of the leading term insurance plan providers in India helping individuals simplify the insurance selection process by allowing users to compare a wide range of policies from leading insurers, ensuring they find the best coverage at competitive premiums.

Email us at info@aapkapolicywala.com to buy an affordable term insurance plan in India.