A lot of people cancel their term or life insurance policy every year even though it provides financial protection to their families in the event of the policyholder’s untimely demise.

Many opt to cancel the term life insurance to free up funds for other financial priorities. However, most suggest against surrendering the policy. To clear the air around canceling a life insurance plan, Aapka Policywala – trusted for online insurance plans in India – will discuss whether canceling the term life insurance policy is worth it or not.

Let’s start by listing out points on how to cancel a life or term insurance plan. Read on!

How to cancel a life insurance policy?

Here are the steps you need to follow for canceling a term or life insurance policy in India:

Review Your Policy: Check if there are any cancellation fees, penalties, or notice periods.

Contact Your Insurer: Connect via phone, email, or the insurer’s website to learn the cancellation process.

Submit a Written Request: Fill out the cancellation form, typically available on the insurer’s website or upon request, and will include your policy number and personal details.

Send the Request: Submit the form by mail, email, or fax, and keep copies for your records.

Confirm Cancellation: Follow up to ensure the policy is canceled and obtain confirmation.

Stop Automatic Payments: Cancel any automatic payments to avoid future charges.

These are the steps you need to follow in order to cancel a term or life insurance policy in India.

Now let’s move ahead toward the primary reasons due to which cancellation on term life insurance takes place.

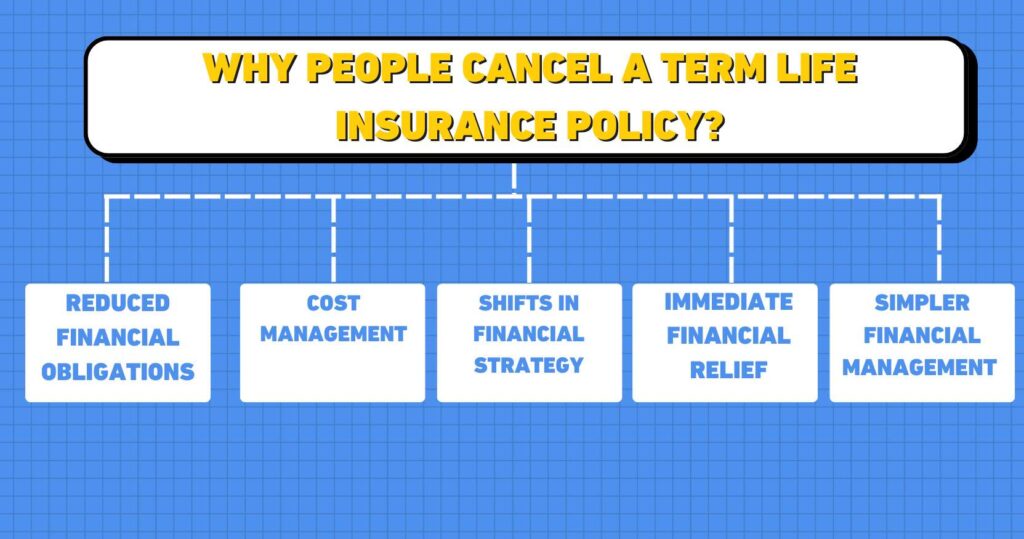

Why People Cancel a Term Life Insurance Policy?

There are many reasons why people consider canceling a life insurance policy. Here are the popular reasons:

Reduced Financial Obligations

One of the most common reasons behind canceling the term life insurance policy is a reduction in financial obligations. For example, if the policy was purchased at first to cover a mortgage, and that mortgage has been paid off, the need for the insurance may seem to appear unwanted now. Similarly, if the children have grown up and have become independent, the financial protection offered by the policy might seem less important.

Cost Management

While the term life insurance is typically less expensive as compared to permanent life insurance, the policyholder still needs to pay a considerable amount as a premium over time. Considering the same, the policyholder’s financial situation may change during/after events like retirement or unexpected expenses. This may lead the policyholder to reduce the monthly outgoings by canceling the term life insurance. Every year, thousands of individuals in India cancel their term life insurance policy in order to reduce their expenses.

Shifts in Financial Strategy

As people approach different life stages, their financial strategies also change. For example, someone who has accumulated significant savings or investments might feel confident enough in their financial security to forgo other saving plans like term life insurance. Canceling the term life insurance policy might be the option individuals opt for as a new financial strategy, using these funds in other directions such as mutual funds or stocks.

Immediate Financial Relief

Canceling a term life insurance policy frees up funds that were previously being paid as premium payments. This can be particularly beneficial if the policyholder is experiencing financial strain, or wants to redirect funds to other priorities such as healthcare, retirement saving or new business starting.

Simpler Financial Management

Reducing the number of financial products one has to manage can simplify overall financial planning. For some, eliminating the term life insurance policy can reduce complexity and make financial management easier.

Individuals and families sometimes see a lot of short-term benefits of canceling the term life insurance. However, it often brings a lot of challenges along with it.

Why Not to Cancel a Life or Term Insurance Plan?

Canceling the policy before maturity time may also bring its share of risk and considerations. Here are they:

Loss of Financial Safety Net

The most significant risk of canceling a term life insurance policy is the loss of the death benefits that provide financial protection to beneficiaries. This safety might be very crucial for covering funeral costs, paying off remaining debts, or providing

Income replacements for the dependents.

Challenges in Requalifying for Insurance

If a policyholder decides to cancel their term life insurance policy but later wishes to obtain new coverage, they might have to pay high premiums or might face difficulty in qualifying due to age or health changes. This can make obtaining similar coverage more expensive or even impossible.

Underestimating Future Needs

Life is unpredictable, and financial needs can change at any time. Canceling a term life insurance policy might seem prudent now, but unforeseen circumstances, such as new financial dependents or economic downturns, could create a renewed need for life insurance coverage.

Check out these popular blogs as well:

Evolution of life insurance in India

Low-cost motor insurance plans in India

Grace period in life insurance

What to do Before Canceling a Term Insurance Plan?

Before canceling a term life insurance policy, it’s essential to conduct a thorough evaluation of one’s financial situation and future needs. Here are some steps to consider:

Assess Financial Obligations: Evaluate current and future financial responsibilities. Consider debts, ongoing living expenses, and the needs of any dependents. Determine whether these can be managed without the death benefit provided by the insurance policy.

Examine Financial Cushion: Review savings, investments, and other sources of income that could provide for beneficiaries in the event of an untimely death. Ensure there is a sufficient financial cushion to cover potential expenses.

Consult a Financial Advisor: A financial advisor can offer personalized advice based on an individual’s specific circumstances. They can help weigh the pros and cons and explore alternative options, such as reducing coverage or converting to a permanent policy, if available.

Consider Partial Cancellation: Some insurers allow policyholders to reduce the coverage amount rather than canceling the policy entirely. This can lower premium costs while still providing some level of financial protection.

Understand the Cancellation Process: Be aware of the insurer’s cancellation policy, any potential fees, and the exact process required to cancel the policy. Ensure that all necessary steps are followed to avoid unintended lapses in coverage.

Canceling a Term Life Insurance: Endnotes

Canceling a term life insurance policy in India is a personal decision that should be thought twice before executing. While there can be valid reasons for considering cancellation, such as reduced financial obligations or the need to manage expenses, it is crucial to weigh these against the potential risks and loss of financial protection.

If you still have questions to ask, email us at info@aapkapolicywala.com to get a reply from experts.

Want to buy an insurance plan from a reputed company at an affordable price in India?

*Enters Aapka Policywala*

We are one of the leading insurance plan providers in India helping individuals simplify the insurance selection process by allowing users to compare a wide range of policies from leading insurers, ensuring they find the best coverage at competitive premiums.

Here are the most loved insurance policies by Indians: