Owning a car or a bike feels wonderful but it also comes with the responsibility of protecting your vehicle with the right insurance. Finding low-cost motor insurance is the priority of most vehicle owners since it promises financial security and peace of mind without big yearly renewal costs.

With so many insurance companies offering motor insurance, it sometimes becomes hard to find affordable car or bike insurance plans. That’s why Aapka Policywala – a leading car insurance service provider in India – will delve into the world of low-cost motor insurance, guiding you toward budget-friendly options that cater to both car and bike owners.

Let’s get started!

Cheap Motor Insurance Plans for Car and Bike

Many insurance providers offer comprehensive motor insurance coverage covering protection against theft, accidents, and third-party liabilities without charging a BIG premium.

Here is the list of 6 best low-cost motor insurance plan providers in India:

HDFC Ergo

The insurance plans of HDFC Ergo Car Insurance have a starting price of just Rs. 2094. This price makes it budget-friendly as well as convenient. No wonder, a lot of people buy car insurance plans with HDFC Ergo. Moreover, in addition, HDFC Ergo has over 8200+ cashless garages network that makes it very easy for policyholders to get their cars repaired. HDFC Ergo’s affordable motor insurance premium and vast network of cashless garages make it a convenient choice for car insurance buyers.

Acko Insurance

The insurance plans of Acko Motor Insurance have a starting price of just Rs. 2762, and they provide both car and bike insurance. Insurers like ACKO are cutting out the middlemen and passing on the savings to insurance buyers. No wonder, they offer policies at low premiums after lowering operational cost. Their online infrastructure helps digital-first insurers to buy motor insurance policies, settle claims, and service policyholders in a hassle-free way.

ICICI Lombard Car Insurance

Experience peace of mind on the road with ICICI Lombard Car Insurance, starting at just Rs. 2095. Enjoy up to 50% Claim Bonus, access to 13,000+ cashless garages, and 24/7 roadside assistance. Plus, you benefit from instant claim settlement with InstaSpect for hassle-free service. Their insurance plans include third-party and standalone options, which give customers a wide range of choices. Their focus on easy claim settlements and quick policy renewals adds to customer satisfaction.

TATA AIG

The insurance plans of TATA AIG motor Insurance have a starting price of just Rs. 3164, and they provide both car and bike insurance. By utilizing their motor insurance plans, you can save up to 75% on car insurance premiums by buying online! Their comprehensive four-wheeler insurance policy offers various benefits like their network of over 6900 garages ensures cashless services for your car repairs. TATA AIG’s impressive 98% claim settlement ratio shows they’re reliable in handling claims efficiently. Their quick three-step process for selecting a plan is user-friendly.

Royal Sundaram Bike Insurance

Royal Sundaram’s focus on providing comprehensive road protection is commendable. The ability to customize plans with add-ons like depreciation waiver cover and NCB protector gives policyholders that extra peace of mind. With their two-wheeler Insurance policy, they shield you from potential losses amounting to lakhs of rupees. One major benefit is not paying any extra premium, even if there’s an increase in third-party premiums during the policy period. Additionally, you have the option to purchase or renew insurance for two-wheelers for two or three years.

SBI General Two Wheeler Insurance

The insurance plans of SBI General Two Wheeler Insurance have a starting price of just Rs. 753. This insurance plan ensures you are safeguarded against accidents, theft, and damages. With SBI General, you can enjoy peace of mind knowing your two-wheeler is protected by a reliable and trusted insurer.

Want to read more? We recommend checking out these blogs too:

How to renew car or bike insurance easily

8 benefits of motor insurance policy in India

What does car insurance cover? Everything you need to know

Learn more about the best two-wheeler insurance online

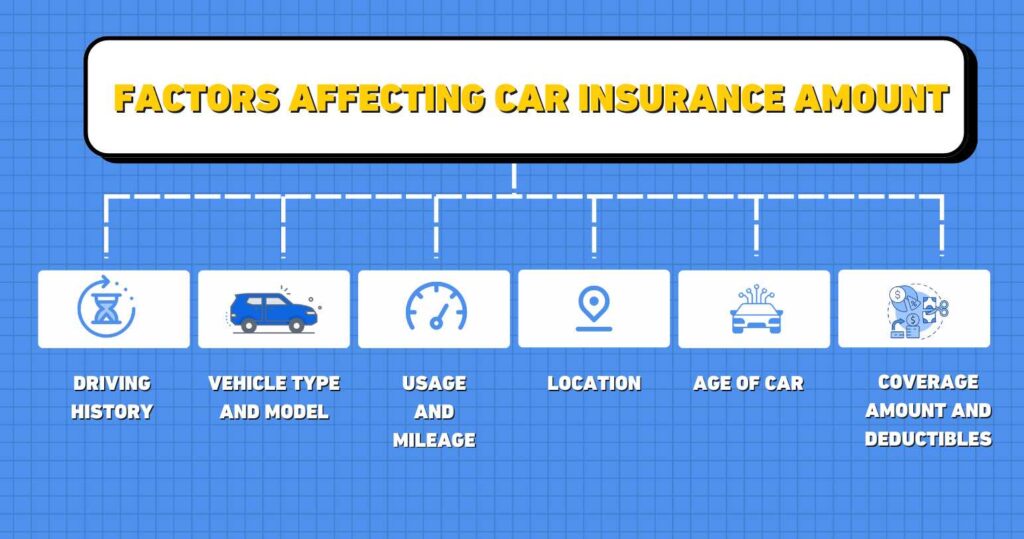

Factors Affecting Car Insurance Amount

Choosing the right car insurance plan is a daunting task as there are a lot of factors that influence the cost and coverage. By analyzing and understanding the influencing factors, you can make an informed decision that leads to money savings.

Here are the key factors that affect car insurance plans:

- Driving History

One significant factor that impacts your insurance premium is your driving record. If you have a clean driving history with no accidents or traffic violations, you can avail the benefit of lower premiums. On the other hand, a history of accidents or violations can increase costs.

- Vehicle Type and Model

Another major factor that determines the car or bike insurance premium is the type and model of the car. The overall value of your vehicle plays a crucial role in determining your insurance rates. Luxury cars, sports cars, and vehicles with high repair and maintenance costs usually attract higher premiums.

- Usage and Mileage

The most important factor that influences insurance rates is how often and how far you drive your car. Vehicles that are used on a daily basis for traveling bring higher premiums. While those that are used infrequently may attract low insurance premiums.

- Location

Your geographic location influences your bike or car insurance costs. Urban areas with high traffic density and higher crime rates often have higher premiums compared to rural areas with lower risks.

- Age of Car

Maintenance costs, assurance of safety, and vehicle damage costs are the main elements that insurance providers cover. So, the older your car is, the costlier the repairs will be. Therefore, the premium of car insurance will be more expensive. For instance, the car insurance premium for a car bought in 2018 will be higher than that bought in 2021.

- Coverage Amount and Deductibles

The level of coverage you choose and the deductibles you are willing to pay out-of-pocket in case of a claim significantly impact your premium. Comprehensive coverage with low deductibles will be more expensive than basic coverage with high deductibles.

Get Cheapest Motor Insurance Plans

Here we go!

Above is the list of the best yet cheapest motor insurance plans that you may consider buying to save money on your next car or bike insurance policy. However, there are a lot of factors that affect the overall premium price and your insurance plan. So, remember to analyze your premium on all the above listed factors before pressing the BUY button.

Got any queries to ask? Please email us at info@aapkapolicywala.com so our insurance experts can answer them. We are also home to some of India’s best insurance service providers and bring the best plans from them.

Have a look at our insurance plans: