Electric vehicles are non-fuel-based; hence, people are shifting towards non-polluting alternatives to traditional gasoline cars. They run with pure electricity rather than fuel, hence making them very different in many ways. It is due to these differences that the insurance for EVs is also different. For instance, EVs have highly expensive batteries and require special maintenance that might affect the insurance premiums and policies.

The changes should be understood by any person seeking to acquire an electric car. Knowing what to expect will help you make better decisions and ensure proper insurance protection. EVs have zero emissions, so they lower your carbon footprint and help to create a cleaner atmosphere.

Understanding electric vehicles :

Electric vehicles are powered by means of an electric motor and a battery, not an internal combustion engine. This difference begets several unique characteristics, which affect their insurance needs. Some of the main attributes of EVs are as follows:

Battery Technology: This is the battery that comes with the largest price tag for any EV. These batteries store the electricity that moves the car. Since they are expensive to replace or repair, insurance companies consider this when determining your coverage and how much you pay for insurance. In case of damage to the battery in an accident, fixing it can be quite expensive, and that is why this aspect is of core concern to insurers.

Maintenance: Generally, an EV has fewer moving parts compared to traditional ones. This can reduce the costs of maintenance as these few parts wear out or tear and break. The EVs, however, demand special services from their constituent parts, like the electric motor and the battery system. This could also imply seeing a mechanic specifically trained in electric vehicles, which can be more or less convenient—or expensive—than regular car repairs.

Environmental Impact: EVs run without tailpipe emissions; that is, they do not emit harmful gases into the atmosphere like other gasoline-powered vehicles. Hence, they are much more environmentally friendly. In view of this upbeat contribution towards the environment, an EV owner is often showered with numerous incentives and discounts in terms of tax breaks, rebates, and lower fees. Some insurance companies may also offer discounts to EV owners because of their eco-friendly nature.

Changes in Insurance Coverage of an EV

You could witness a lot of changes in the insurance of an electric vehicle compared to the insurance of a traditional car. These include:

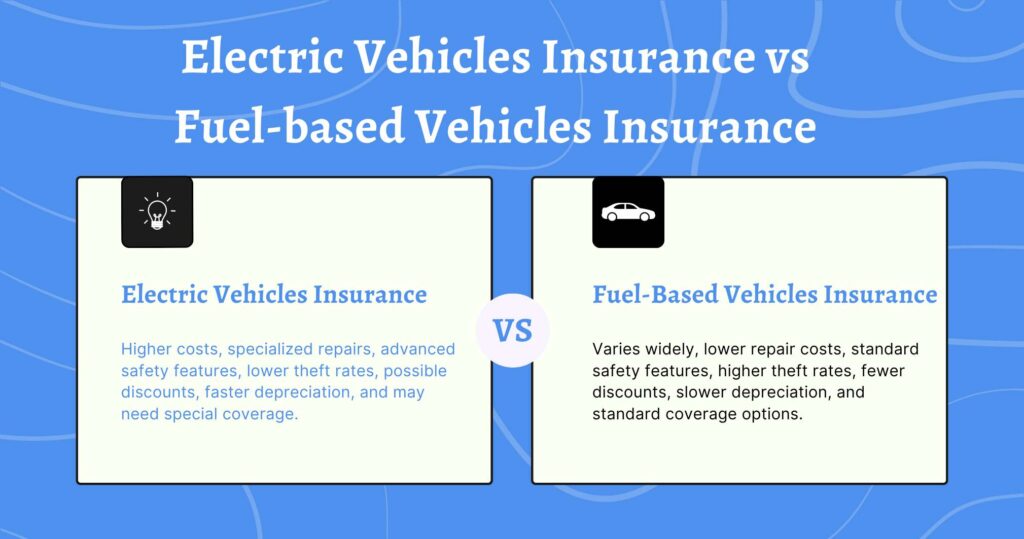

Higher Premiums: The upfront cost charged by EVs is way higher than that of gasoline-powered cars. For instance, a new electric car may come in at ₹25 lakhs and a similar gasoline car at ₹15 lakhs. Since EVs are much more expensive, their repair or replacement is costlier. Entailing huge repair bills in case of damage during an accident means your electric car is going to be pretty costly. Hence, with higher insurance premiums, you end up paying more for your insurance coverage as compared to a traditional car.

Coverage for Batteries: The battery in EVs is a very expensive component. Moreover, if it is damaged, the replacement or repair may be very expensive and can run into several lakhs of rupees. For instance, the replacement of the EV battery may cost ₹3 lakhs to ₹7 lakhs. That is why insurance policies for EVs provide special coverage for damages or the replacement of batteries. This means that in case your battery is damaged, your insurance helps to cover the costs since damage to the battery can be very expensive.

Expert Repairs: As much as electric vehicles are slowly gaining their way into the global car markets, they require special knowledge and equipment to repair them. Not every mechanic can fix an EV because they need to know how to operate the electric motor, the battery system, and all the other uniquely designed parts. An example is when your EV needs some repairs; it may have to be taken to a certified technician who has special training. Such provisions could be part of an insurance policy stipulating the use of these certified repair shops. This can, therefore, affect your coverage choices and repair costs. An IT service specialising in repair ensures your EV is done in the right way, but often it’s very expensive.

Roadside Assistance: Running out of battery can be quite difficult, especially in the case of electric vehicle owners. Most policies that include EVs will have full roadside assistance to help with this. For example, in the event of a battery drain on the way, the insurance will cover towing your vehicle to a nearby charging station. This turns into an essential feature for EV owners because finding a charging station is more troublesome than finding a gasoline pump, especially in less crowded areas.

Discounts and Incentives: Some insurers offer discounts for EV owners since electric cars have a lower impact on the environment and are engaged in fewer types of accidents. For example, many insurance companies cut 10 percent off your premium for driving an electric vehicle. Many governments also give people who buy EVs incentives in the form of tax breaks or rebates. These would indirectly bring down your insurance costs by giving you more money in your pocket to pay for insurance premiums. For instance, the government gives you a ₹1.5 lakh rebate when buying an EV, which may offset the increased insurance costs.

Factors Determining the EV Insurance Premiums

There are quite a few influencing factors when it comes to the premiums to be paid for an electric vehicle. Knowing them will facilitate the decision-making process regarding the insurance policy.

Vehicle Value: Insuring an electric vehicle is highly dependent on the market value of your EV. Therefore, more prestigious models will induce high price rates.

Battery Cost and Life: The category and cost of the battery, along with rated-life-turn-sensitive factors. The insurers factor in the risk and cost associated with the new battery.

Cost of repair: The ease of getting hold of replacement parts and the cost of the same, as well as the complexity of any repair tasks, weigh heavily on insurance costs. In many cases, the EV requires specialised work to repair, and it is more costly than the same repair for a traditional vehicle.

Driving record and habits: Your driving record and habits are major factors that go into calculating premiums. One can expect lower premiums if one drives safely, while frequent claims or accidents definitely raise the costs.

Usage Patterns: The way you make use of the EV—daily, occasional, or otherwise—impacts coverage and premiums. Higher usage would definitely mean a higher premium since the exposure to risk is greater.

How to Lower EV Insurance Costs?

Though EV insurance is more expensive than that of conventional cars, there are ways to bring such costs down. Here are some tips:

1. Shop Around: One of the biggest variables in premiums exists between providers. Start comparing the quotes from various insurance companies to get your electric vehicle premium at the best deal. This move allows you to get the most competitive rate since every insurer will have different models for pricing and discounts.

2. Bundle Policies: Consider bundling your electric vehicle insurance with other insurance you have, like your house or life insurance. Most insurance companies offer discounts if you combine several insurance policies. This will result in saving a huge amount of money from your pocket on overall insurance costs.

3. Increasing Your Deductibles: A deductible refers to the amount that you will pay in your pocket when you make a claim before the insurance coverage takes over. At times, if you have increased the deductibles in your premium policy, then it becomes less because you have taken up more risk. Be very careful, however, when choosing the deductible amount; it should be such that you can easily raise those funds immediately in case you need to file a claim.

4. Avail Discounts: Most of insurance companies give a discount on premiums, especially for electric vehicles. These could be discounts for eco-friendly cars or even features that make a car safer, like advanced driver assistance systems or anti-lock brakes. Accordingly, the policyholder should enquire from the insurers about the range of discounts to reduce the premium burden.

5. Clean Driving Record: How clean your driving record is goes a long way to determine how low or high your insurance premium is. A record with no accidents and traffic violations proves you to be a responsible driver, and, once again, this shall reflect on the insurance premium. All these companies charge less premium to insurance holders who have shown a record of safe driving.

6. Anti-Theft Devices: Putting in anti-theft devices helps minimize possible risk compared to an EV being stolen or vandalized. Most insurers offer competitive premiums for vehicles fitted with an anti-theft system as per their criteria, which would mean having either an alarm, an immobilizer, or a GPS tracking device installed. Not only will these protect your car, but in addition, they can lower your insurance costs.

The Future of EV Insurance:

With the ever-growing popularity of electric vehicles, they seem to change the insurance game by accommodating the unique needs for EV owners. Here are some future trends one can watch out for:

Usage-Based Insurance: Most insurance companies are, at some point, going to have usage-based plans that account for how you drive your EV. Those plans can be tailored to be more personalised and lower in cost.

Advanced data analytics and EVs will be integrated with telematics, and this is going to allow insurers to come up with a risk assessment with very high accuracy, enabling them to quote premium prices based on real-time information. The more the EV market expands, the more additional coverage options insurers develop; some of these are more tailored coverage options, such as improved protection for batteries and coverage against cyber threats from connected vehicle technologies.

Collaboration with Automakers: Closer coordination by insurance companies with EV manufacturers in offering integrated insurance solutions directly at the sale point will help interested consumers fast-track their desires.

The future wave of any automobile company is towards electric vehicles, and thus insurance companies as well. There is one important thing for current and future EV owners: understanding how coverage for EVs changes. Be aware of what’s going to make your premiums rise and take measures to control these costs through @aapkawalapolicy.com —you want to make sure you’re well-covered without breaking the bank. Whether you are an early adopter or someone who wants to switch, awareness about the trends in EV insurance will always help you steer through this changing market. Be it any kind of help in regard to EV insurance, Aapka Policy Wala will always be there for you.