A family health insurance policy provides financial protection and peace of mind to the insured family members. However, choosing the right family health insurance plan in India is a crucial decision that requires careful consideration and expert tips.

Some families planning to buy a family health insurance policy often struggle to choose the right one. That’s why we created this blog to simplify the decision. In this blog, Aapka Policywala – trusted for family health insurance in India – will share 10 tips for choosing a family health insurance policy. Let’s start!

Tips to Choose Family Health Insurance Policy

Below are the expert tips and ideas for choosing a health insurance policy for your family:

Assess Your Family’s Needs: The younger members of the family usually have fewer health issues while seniors require frequent medical attention. So, the first tip is to understand your family’s specific healthcare requirements. Consider any pre-existing conditions, chronic diseases, and potential hereditary health issues.

Compare Different Policies: Use online resources to compare different health insurance plans for your family. Always look for policies that offer a balance between affordable premiums and comprehensive coverage. Don’t forget to compare the extent of coverage including inpatient hospitalization, outpatient treatment, and other benefits.

Sum Insured: While choosing a health plan for your family, make sure that the sum insured is good enough to cover potential medical expenses. For example, a large family or one with elderly members might require a higher sum insured.

Also, consider the rising cost of healthcare and inflation. Our POSP agents recommend going for a sum insured that can accommodate future medical expenses.

Comprehensive coverage: Look for a family health policy that offers wide-ranging coverage including hospitalisation expenses, day-care procedures, pre & post hospitalisation coverage, and additional benefits. In short, you must make sure that your policy covers expenses like room rent, ICU charges, doctor fees, surgery costs, maternity coverage, critical illnesses, and more.

Network Hospitals: A wide network of hospitals ensures that you can conveniently benefit from cashless treatment. Make sure the good hospitals near your residence are included in the policy. You can also look for preferred hospitals and specialists while buying a healthcare policy for your family.

Waiting Periods: Healthcare policies typically have a waiting period for pre-existing conditions and certain treatments can have a long waiting period. Also, check the waiting period for maternity coverage as the waiting time for it can be between 9 months to 4 years. This is crucial if you plan to expand your family soon.

Co-payment and Sub-limits: Some family health plans in India require the policyholder to pay a percentage of the claim amount. Choose family health policies with minimal or no copayment to get max benefits. Ensure the sub-limits on room rent, specific treatments, and surgeries are reasonable or you can also opt for policies without such restrictions.

Claim Settlement Ratio: For those who don’t know, the claim settlement ratio indicates the insurer’s reliability. A higher claim settlement ratio means the insurer is more likely to settle claims efficiently. Also, consider the average time taken by the insurer to settle claims. Prompt settlements are crucial during medical emergencies like accidents.

Add-on Covers: Life-threatening diseases like cancer and heart attacks are becoming pretty common nowadays. So, if your family has a history of such conditions, it’s wise to get add-on cover for it. Consider opting for add-on that include financial protection in case of accidental death or disability and a daily cash allowance for the duration of hospitalization.

Buy the best individual health insurance in India at affordable prices.

Premiums and Affordability: The last tip for buying a family health plan is to ensure that the policy fits within your budget. Weigh the benefits against the premium cost and don’t compromise on essential coverage for a lower premium. Check the options for premium payment frequency and choose one that suits your financial planning.

Now that you are aware of expert tips and ideas for choosing a family health policy, let’s discover why it is important for Indian families to buy health insurance plans.

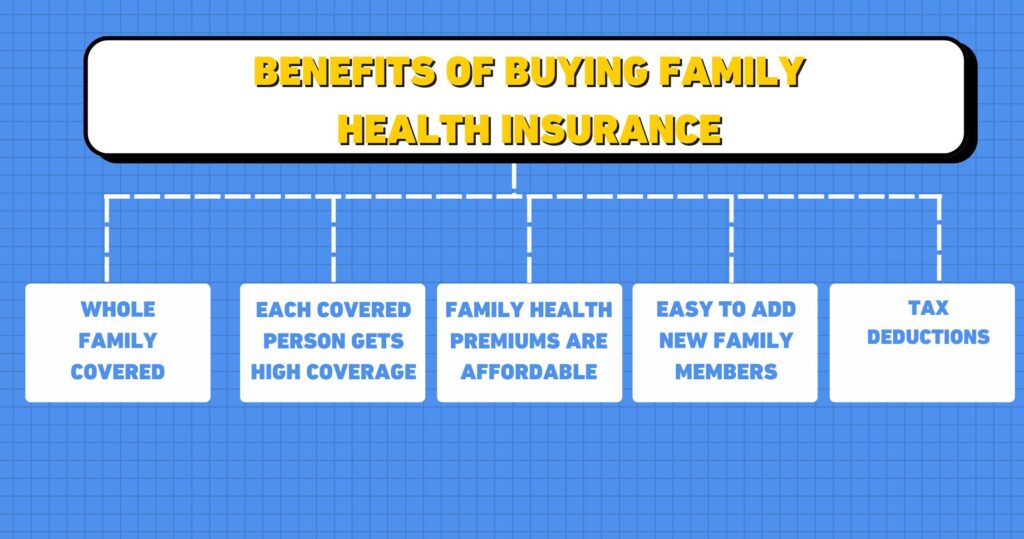

Benefits of Buying Family Health Insurance

Below are the major benefits of buying a family health insurance policy in India:

Whole family covered: Family health insurance plans in India cover all family members under a single plan. Some family health insurance policies also allow you to cover your extended family (like parents). If you have a dependent parent-in-law, some family health insurance companies also cover that..

Recommended: Learn everything about critical illness insurance plans in India.

Each covered person gets high coverage: A family health insurance policy allows the use of the entire amount of the sum insured by any covered member who needs it. It gives family members complete access to the sum insured and can avail a high coverage if you choose an optimal sum insured level.

Family health premiums are affordable: Family health insurance plans are affordable in comparison to purchasing individual policies for each person in the family. In short, affordable family health insurance plans are good news for your wallet!

Easy to add new family members: Family health insurance policies in India make it easy to add new family members. For example, if anyone in your family gave birth to a child, you may be able to get your child covered from the middle of the policy term. It depends on the terms and conditions of the plan you choose.

Tax deductions: The last and most important benefit of buying a family health insurance plan in India is that it allows you to get tax benefits. The tax benefits you get after buying a family health insurance policy are under Sections 80C and 80D of the Income Tax Act 1961.

Buying Family Health Insurance Policy in 2024

We hope that this blog gives you a fair idea of choosing the right family health insurance policy. Remember, the goal of buying a family health insurance policy is to have adequate protection against medical emergencies without financial burden. So, don’t skip that health plan premium!

Got any queries to ask about family health plans in India? Please email us at info@aapkapolicywala.com to connect with one of our insurance experts. Feel free to explore our website to buy health insurance plans for your family from our partner insurance providers.

Want to read more? We recommend checking out these blogs too:

8 best pension plans in India

8 health insurance plans for family