In 2024, life insurance is the cornerstone of every financial plan. It safeguards your loved ones’ financial well-being in the unfortunate event of your passing. But do you know that it wasn’t always the comprehensive product it is today? Yes, you read it right! Much like technology, life insurance has undergone a remarkable evolution over the centuries.

India’s rich history is intertwined with its development which is the reason why it boasts significant milestones over the past few centuries. Aapka Policywala will tell you about the evolution of life insurance plans in India. Keep reading because you’ll surely find this journey very interesting!

It might even make you appreciate the illustrious history of insurance in India and life insurance options available today!

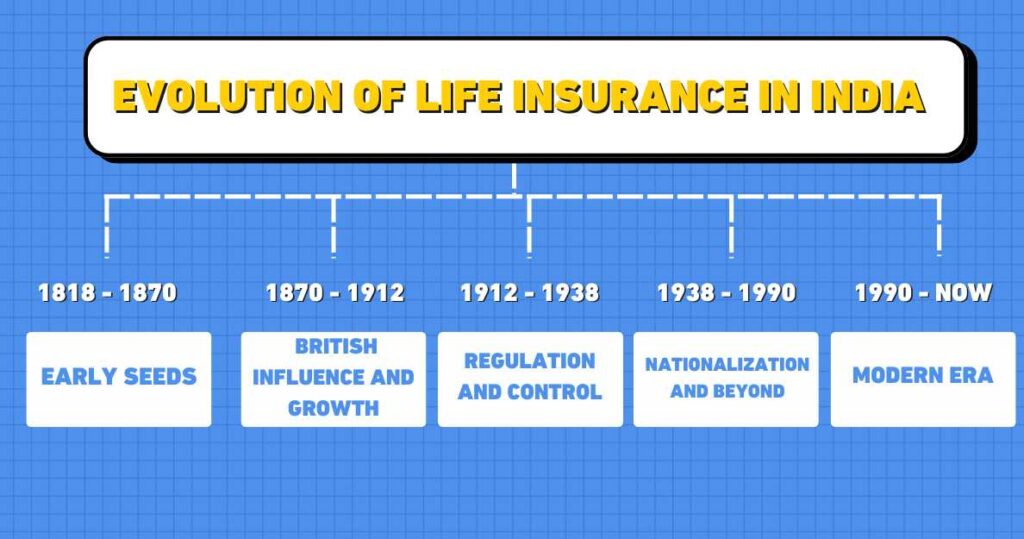

How Life Insurance Policy Evolved in India?

Life insurance in India boasts a rich and fascinating history. It mirrors the country’s own journey towards development. From modest beginnings to refined plans available in 2024, here’s a glimpse into its remarkable evolution:

1 Early seeds (1818-1870)

The first attempt at life insurance in India came in 1818 with Oriental Life Insurance Company’s establishment in Kolkata. However, this endeavor turned out to be unsuccessful. It closed its doors in 1834. Undeterred, the Madras Presidency saw the rise of Madras Equitable in 1829. This was another early attempt at life insurance.

2 British influence and growth (1870-1912)

The British Insurance Act (BIC) enactment in 1870 ushered in a new era. This act paved the way for establishing several insurance companies in the Bombay Presidency including prominent names like Bombay Mutual, Empire of India, and Oriental.

Moreover, foreign insurance giants like Royal Insurance and Albert Life insurance set up their offices in India, creating intense competition. Indian companies struggled to establish themselves amidst these international giants at that period.

3 Regulation and Control (1912-1938)

Recognizing the need for order in the ever-growing insurance market, Indian Life Assurance Companies Act was introduced in 1912. Why was it introduced? To regulate the life insurance sector in India. It marked a significant step towards greater transparency and accountability.

And if you think this was the only thing that happened during the evolution of life insurance at that time, you’re wrong! The government of India also took the initiative to publish data on the business and returns of life insurance companies. This allowed for better market understanding.

The year 1928 saw the enactment of Indian Insurance Companies Act. It aimed to analyze operations of both life and non-life insurance companies, be they foreign or Indian. A real crucial step in ensuring the stability and responsible functioning of the insurance sector in India!

Building upon this foundation, the existing legislation was revised in 1938 as Insurance Act 1938. This act included necessary provisions to regulate and control the activities of insurance providers more sufficiently.

Learn about the benefits of buying health insurance plans in India!

4 Nationalization and beyond (1938-1990s)

This period of life policy insurance evolution is when India witnessed a surge in several new insurance companies entering the Indian market. During the period between 1938 and 1956, increased competition also led to some instances of unsuitable business practices. As a result, the Indian government decided to take a bold step and nationalise the life insurance sector.

The Life Insurance Corporation (LIC) of India was established in 1956. It absorbed a staggering 154 Indian insurance companies, 75 provident societies, and 16 non-Indian insurers. LIC dominated the life insurance market for several decades. It offered a sense of stability and security to policyholders.

But then winds of change began to blow. In the early 1990s, the Indian economy witnessed significant liberalization, and the insurance sector was no exception! The government opened doors for private players to enter the insurance market, injecting a needed dose of competition and innovation.

5 Modern era (1990-present)

We bet that just by reading the heading, you’ve already guessed which part of insurance plan evolution we’re discussing. Welcome to the modern era! With the entry of private players, the life insurance scene in India saw a dramatic transformation. Today, policyholders have access to plethora of insurance plans catering to diverse needs and financial goals.

These plans offer features like investment-linked options, riders for critical illness or accidental death, and flexible premium payment structures. And that’s not it! Technology has also played its part in this transformation. How so? By making the process of buying and managing life insurance policies faster, easier, and more accessible.

Where to Get a Life Insurance Policy in 2024?

Now that you are aware of this fascinating journey through the evolution of life insurance in India, it’s time to navigate the exciting present! Given that there are many companies vying for your attention in 2024, selecting the right insurance partner can feel overwhelming.

We are not just another insurance company but a one-stop platform that simplifies your life insurance search. On our insurance discovery platform, you’ll find a comprehensive range of policy plans from various reputable insurers in India. You can compare plans, features, and benefits from the comfort of your home.

In fact, our UI will let you filter plans based on your requirements and budget. Seeking a traditional term plan? A wealth-building plan? Wait, a combination of both? We have options to suit every financial goal!

Learn about the best life insurance companies in India!

Evolution of Life Insurance Policy in India: Final Words

There you go!

We explained to you the different phases involved in the evolution of insurance policies in India. As you’ve seen, the journey has been marked by innovation, regulation, and constant striving to provide greater security for policyholders. Now that you’re equipped with this knowledge, are you set to explore the exciting world of life insurance and secure your loved ones’ future?

If yes, browse our collection of insurance policies today! Got any queries to ask? Send them to info@aapkapolicywala.com and have them answered by our PSOP agents.