We all dream of a secure future for ourselves and our families. But only a few of us know how to build it, brick by brick. One way is buying an endowment policy. It’s trusted by millions because it guarantees a lump sum payment whenever you need it. We know there are a lot of questions going on in your mind like:

- What exactly is the endowment policy about?

- Why is it creating buzz?

- Who should buy an endowment policy?

Don’t worry. In this blog, Aapka Policywala will break down everything you need to know about endowment policy plans. From meaning to different benefits and policy types and buying platforms, we will cover all crucial aspects.

Let’s start!

What is an Endowment Policy?

An endowment plan is like planting a financial seed today. As time passes, you watch it blossom into a guaranteed lump sum in the future! It’s a life insurance plan that combines two key features:

- Protection of your loved ones in case of an unfortunate event.

- Guaranteed payout upon maturity.

Put simply, it’s a way to save consistently while having your back covered – all in one place.

Why Buy Endowment Policy?

Endowment plans have become a popular option for people seeking an amalgamation of financial security and long-term savings in India. But still, some aren’t sure why they should consider this type of policy. Given there are a plethora of investment options available, we don’t blame them.

The following are some reasons why this unique insurance product can be a valuable addition to your financial toolbox:

- Guaranteed maturity benefit: Unlike market-linked investments that fluctuate, endowment plans offer a guaranteed payout at the policy’s maturity. This simply translates to peace of mind, knowing you’ll have a specific sum to achieve your long-term goals. Whether it’s a child’s education, a dream vacation, or a comfortable retirement.

- Life insurance protection: This type of insurance policy goes beyond savings. How, you ask? Well, it offers a built-in life insurance benefit. In case of an unfortunate event, your loved ones will receive a death benefit. Meaning, you’ll still be able to provide financial support and protect their well-being even if you’re not there.

- Encourage discipline: Struggle with consistent saving? No problem, endowment plans can be a paradigm shift in your life. By setting up regular premium payments, you establish a disciplined savings habit. Long-term commitment to this policy will motivate you to stay on track. Also, to build a substantial corpus over time.

- Tax advantages: Another known benefit of buying an endowment policy in 2024! It offers attractive tax benefits that can immensely boost your savings. Premiums paid towards the policy qualify for tax deductions under Section 80C of the Income Tax Act in India.

What’s more, the maturity benefit received is partially or fully tax-free (depending on the plan chosen).

- Loan availability: Life sometimes throws bolts from the blue. Endowment plans will provide the option to avail of a loan. Yes, against the policy’s surrender value! You can literally access funds for unforeseen circumstances without disrupting your savings plan.

- Peace of mind: Buying an endowment policy = gaining peace of mind, knowing your future is secure. You can focus on the present and pursue your goals with confidence.

Buy an endowment insurance policy online on Aapka Policywala!

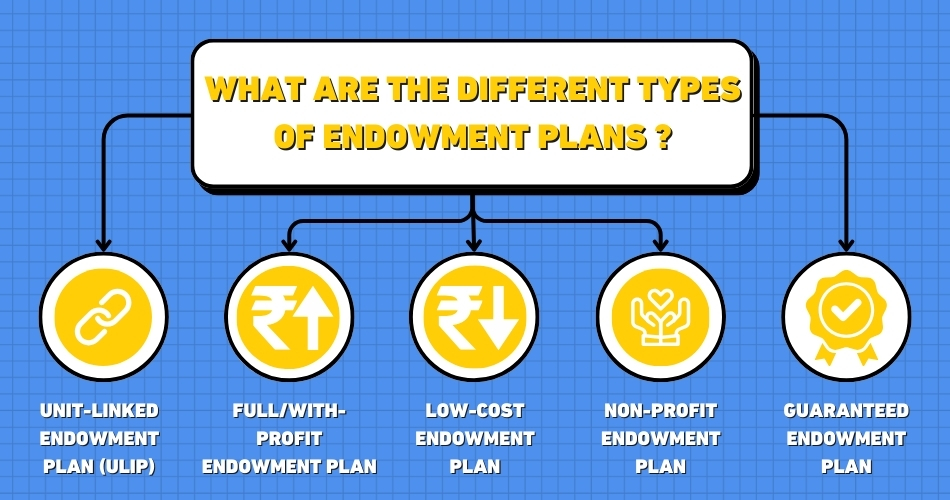

What are the Different Types of Endowment Plans?

Now that you’re familiar with the meaning and benefits of endowment plans, it’s time to focus on the burning question, “What are its different types?” Here are different types of endowment plans, each catering to specific financial needs and risk appetites:

- Unit-linked endowment plan (ULIP): For the risk-taker seeking market growth, ULIPs offer a remarkable mixture of insurance and investment. You will be asked to allocate a small part of your premium to investment funds (equity, debt, or balanced). The returns will rely on the market performance of these funds.

Although ULIPs offer the potential for high returns, they also carry risk of market instabilities.

- Full/with-profit endowment plan: A traditional endowment plan that offers guaranteed security! You will receive a predetermined sum assured upon maturity. That too with potential bonus payouts announced by the insurance company based on its performance. Unlike ULIPs, it offers a persistent return with lower risk.

- Low-cost endowment plan: Next up, we have a low-cost endowment plan. As the name suggests, it’s a budget-friendly option that emphasizes guaranteed savings. Premiums are typically lower. About focus, well, it’s on hoarding a specific sum assured at maturity. This type of endowment plan is ideal for compiling a corpus for defined goals. Down payment on a house, for instance!

Yes, it offers low returns but comes with guaranteed benefits.

- Non-profit endowment plan: A straightforward plan that offers a fixed sum assured payout upon maturity or death benefit to the beneficiary. There are no bonuses or profit sharing. Not only does it provide protection but also a guaranteed return. Overall, this type of endowment plan is appropriate for those desiring a simple and predictable savings option!

- Guaranteed endowment plan: Guaranteed endowment plan is all about its name – guaranteed benefits! It presents a fixed sum assured upon maturity. That too with a prospect of non-guaranteed bonuses. It provides a balance between assured returns and the potential for additional benefits.

Here, learn everything about ULIP insurance online!

Best Place to Buy Endowment Plan Online

Okay, we understand that finding the right endowment plan can feel overwhelming (given that there are so many options available). Here’s where Aapka Policywala steps in! Our experienced advisors will understand your needs and recommend plans that perfectly align with your financial goals and risk tolerance.

But that’s not it! Here are more reasons why our platform is your one-stop shop for a secure future:

- Simplified comparison: We offer a user-friendly platform to compare different endowment plans from leading insurers. Transparent comparisons allow you to make informed decisions.

- Hassle-free process: Aapka Policywala handles the entire application process. We make sure you have a smooth and efficient experience. Our PSOPs will take care of your paperwork, leaving you free to focus on what matters most.

- Unwavering support: We provide ongoing support throughout your policy term. Our customer service team will be always available to answer your questions and address any concerns.

- Committed to savings: When you’re buying policies on our platform, you don’t have to worry about pricing. We negotiate on your behalf to get you the best possible premium rates, maximizing your savings potential.

Buying Endowment Policy Plan: Final Words

There you go!

We told you everything important about purchasing an endowment policy plan in 2024. Now you are equipped to make an informed decision about securing your future. Remember, financial planning is not a destination but a journey. Aapka Policywala is here to walk with you every step of the way.

Don’t hesitate to reach out for personalized advice or explore the various endowment plans available on our platform. Send us an email at info@aapkapolicywala.com in case of queries.

Let’s build your secure future together!

Check out these insurance options: