The concept of a grace period is especially significant in the complex world of insurance. A world where timely payments are crucial for guaranteed financial security. However, many policyholders in India, especially those who recently bought one, are unaware of this crucial period. They don’t know how a grace period works or how it can impact their coverage.

If you’re one of them, keep reading! In this blog, Aapka Policywala will tell you everything important about the grace period in life insurance. By the end, you’ll be a well-informed policyholder who can confidently navigate your life insurance coverage and ensure your loved ones are always protected.

Let us first understand the actual meaning of grace period!

What’s a Grace Period?

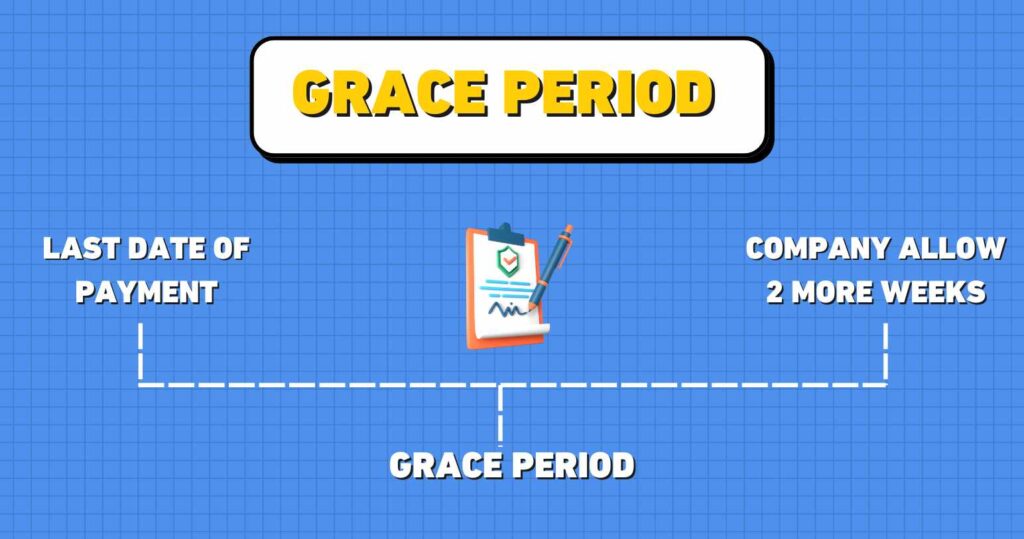

There’s no denying the fact that good life insurance offers peace of mind. No feeling is better than knowing your loved ones are financially protected in case of your passing. But what happens if you miss a premium payment? Here’s where the grace period comes in!

Think of it as a buffer zone. Your insurance company provides a temporary window of time after your due date to make your payment and avoid any lapse in your coverage. A grace period ensures that a minor hiccup doesn’t jeopardize your policy’s benefits.

How Does a Grace Period Work for Life Insurance?

As they say, life can throw curveballs. And sometimes paying your insurance premium on time can fall by the wayside. Thankfully, the grace period exists to provide a buffer zone. Here’s an example of how it works:

You’re Mr. Narula, a responsible policyholder with a health insurance policy. Unfortunately, due to an unexpected job loss, you’re unable to pay your premium by the due date of June 2nd, 2024. This could potentially lead to a lapse in your coverage and leave you vulnerable financially.

However, your insurance company offers you a 15-day grace period. This means you still have until June 17th, 2024 to make your payment without any consequences. During this period, your coverage will remain active. It ensures that you are still protected if unexpected happens.

As day passes, Mr. Narula a.k.a you manage to secure some temporary income. You make your premium payment on June 12th, 2024, within the grace period. Thus, your health insurance coverage continues uninterrupted.

That’s exactly how a grace period for an insurance policy works. It caters to unexpected incidents as a contingency plan. Basically, helping you keep your cover despite delays!

What Happens if Premium is Not Paid After Grace Period?

Life happens. And sometimes, a missed premium payment can feel inevitable. But before you decide to postpone that payment, consider these drawbacks that come with forging again your financial guard:

1 Coverage catastrophe

Okay, what’s the primary purpose of an insurance policy? It is to provide you financial protection when you need it the most, of course. However, failing to pay your premium within the grace period can render your claims invalid. Meaning, that if a health issue arises or say your car gets damaged, you’ll be left to foot the bill entirely the very situation your insurance was meant to prevent.

Recommended: 8 health insurance plans for family worth buying in 2024!

2 Pre-existing illness predicament

Many insurance policies cover pre-existing medical conditions but only after a specific waiting period. Missing your premium and letting your policy lapse rests this waiting period. So, if you want medical care for a pre-existing condition after a lapse, you might have to wait an additional period before your coverage kicks in.

In simple words, you’ll be left vulnerable to significant medical expenses!

3 NCB nightmare

For responsible policyholders who haven’t made any claims, most insurance companies offer a No Claim Bonus (NCB). Translation, lower renewal premiums! You’ll be rewarded for being a safe and responsible policyholder. But.. (here comes the twist) missing a premium payment even after the grace period can result in losing your accumulated NCB, leading to a higher renewal cost.

4 Critical illness conundrum

Critical illness riders add an extra layer of protection to your insurance by covering specific serious illnesses. These riders often have a waiting period before benefits are available. If you miss a premium and your policy lapses, you might have to serve this waiting period again. Yes, before receiving any critical illness benefits!

5 Renewal roadblock

Letting your life, health, or motor insurance policy lapse due to missed payments can create a significant hurdle when trying to renew your coverage. You might not be eligible for the same beneficial terms you had before. Some insurers might even charge a penalty fee for reviving a policy.

What’s worse, a lapse in coverage might make it difficult to find a new insurer willing to cover you. This can be true especially if your health has changed since the initial policy was issued.

6 Profitability predicament

Profitability allows you to switch insurance companies while keeping your existing coverage and accumulated benefits. However, if your policy lapses due to your non-payment after the grace period, you will lose this profitability option. You might be forced to start fresh with a new insurer. Potentially, losing any accumulated benefits or facing higher premiums.

Get or renew your best life insurance policy with Aapka Policywala!

Is it Wise to Revive a Lapsed Life Insurance Plan?

We bet now you understand the drawbacks of not paying premiums even within the grace period. The good news is most Indian insurance companies offer a revival period – typically 2 to 3 years after the grace period ends. But should you revive your lapsed policy or opt for a new one?

Well, that decision depends on many factors. For starters, consider revival costs. This includes premiums, fees, and medical tests. And then compare them to the premiums of a new policy. Think about your current health status. A new policy might require new medical tests which could affect your eligibility or premium amount.

As we said, the choice is yours! Weigh the pros and cons carefully to make an informed decision that best suits your current financial situation and future needs.

Life Insurance Grace Period: Final Words

There you go!

We told you everything important about the grace period in life insurance. By understanding this crucial window, you can make sure your coverage remains active and protect your loved ones in their time of need. Haven’t purchased a life insurance policy yet or looking to explore new options?

Aapka Policywala can help! We offer a wide range of insurance plans to suit your specific needs and budget. Contact us today for a free consultation. Get started on securing your family’s financial future.

Check out these insurance options:

Guaranteed return plans online

These blogs might interest you as well:

NPS vs. ULIP: Major differences

What does car insurance cover?

All about surrender value