Navigating the life insurance claims process can often seem daunting, especially during the emotionally challenging time following the loss of a loved one. However, understanding this process is crucial for ensuring that the benefits of the policy are efficiently and effectively received by the beneficiaries.

That’s why Aapka Policywala – a trusted online insurance company in India – decided to elucidate the life insurance claim process. Delve into each step of the life insurance claims process in detail to ensure a smooth and efficient experience. Let’s first understand the importance of life insurance claims.

Why are Life Insurance Claims Important?

Life insurance is a crucial financial tool created to offer financial support to the policyholder’s family during times of uncertainty like death. The claim process ensures that the policyholder’s family receives all the death benefits claimed to be given by the insurance company. These claims help the family members recover from medical expenses paid during the treatment, pay off debts, and also secure the family’s financial future after the demise of the policyholder.

Now let’s understand the life insurance claim process!

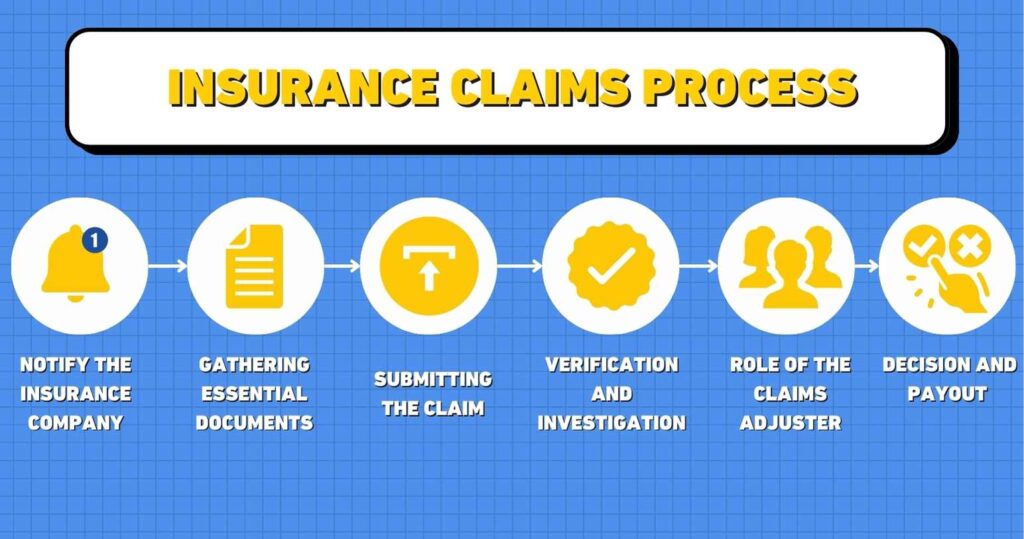

Step 1: Notify the Insurance Company

The initial step involved in claiming life insurance is notifying the insurance company about the policyholder’s death. This communication part should be done as soon as possible to start the process smoothly. Typically, the beneficiary or the family members are responsible for availing the claim. Nowadays, notifications can be provided online, or over the phone. However, you can also visit the insurance company branch to notify them.

Here are the key information to be provided:

- Policyholder’s full name

- Policy number

- Date and cause of death

- Contact information of the beneficiary or claimant

Step 2: Gathering essential documents

After the insurance company is notified about the demise of the policyholder, the next step is to gather all the required documents. These documents are necessary to confirm the identity of the policyholder, verify the claim, and ensure that it meets all the policy’s terms and conditions. The documents required for verification are:

Claim Form

The claim form will be provided by the insurance company and needs to be filled out by the beneficiary or the claimant. This form includes information about the policyholder, beneficiary’s information and set of conditions under which death occurred.

Death Certificate

A copy of the original death certificate is required. This document officially notifies the death of the policyholder and is usually issued by the local municipal authority or the hospital in India.

Policy Documents

The original policy document is required to confirm the terms of the policy and the sum assured. This is super important. In case you have lost the policy documents, notify the company about it and get new ones.

Identification Proof

Proof of identity and relationship with the deceased (such as an Aadhaar card, PAN card, or passport) of the beneficiary.

Step 3: Submitting the Claim

After collecting all the essential documents, the next step involves submitting the claim to the insurance company. This normally is done by the branch manager available at the office, by mail or through the insurance company’s online portal.

Here are some essential tips you need to consider while submitting the claim:

- Please ensure all the information filled in the claim form is accurate and complete.

- Proof-check that all the required documents are included in the file created for the claim process.

- Don’t forget to keep a copy of all the documents you are going to submit to the insurance company’s branch office.

Step 4: Verification and Investigation

Once the claim is submitted, the insurance company will begin the verification process. This step is crucial for ensuring that the claim is legitimate and adheres to the policy’s terms and conditions.

What to Expect:

Verification of Documents: The insurance company will verify the submitted documents to ensure they are authentic and complete.

Medical and Hospital Records: In case of death due to illness, the insurer may request medical and hospital records to verify the cause of death.

Investigation for Accidental Death: If the death was accidental, an investigation might be conducted, which could include police reports, post-mortem reports, and other relevant documents.

Step 5: Role of the Claims Adjuster

The claims adjuster plays a pivotal role in the claims process. They are responsible for reviewing the claim, verifying the details, and making recommendations regarding the approval or denial of the claim.

Responsibilities of the Claims Adjuster:

Reviewing the Claim: They will thoroughly review all submitted documents and information.

Communicating with the Beneficiary: They might contact the beneficiary for additional information or clarification if needed.

Making a Decision: Based on their review, they will recommend whether the claim should be approved or denied.

Step 6: Decision and Payout

After the insurance company is done with the verification of all the documents, the insurance company will be ready to make the final decision on the claim. This decision will be communicated to the beneficiary or the claimant by email or phone call if approved. After this, the payout process begins!

Here are the different ways to receive the payouts:

Lump Sum: The entire claim amount is paid out in a single lump sum.

Regular Income: The death benefits are paid out at regular intervals, such as monthly or annually.

Combination: A portion of the benefit is paid out as a lump sum, and the remainder as regular income.

Life Insurance Claim Process: Endnotes

We hope you have understood the life insurance claim process in India. From the initial notification to the final payout, each step required careful attention to detail and timely action in case of any problem. By keeping these steps of the claim process, claimants can smoothly navigate the claim, reducing the stress in the difficult time.

Still have questions to ask, email us at info@aapkapolicywala.com to get a reply from experts.

Want to buy an insurance plan from a reputed company at an affordable price in India?

*Enters Aapka Policywala*

We are one of the leading insurance plan providers in India helping individuals simplify the insurance selection process by allowing users to compare a wide range of policies from leading insurers, ensuring they find the best coverage at competitive premiums.

Here are the most loved insurance policies by Indians:

Check out the recent blogs we have written as well:

8 best pension plans in India

8 health insurance plans for family

How to renew care or car insurance8 benefits of motor insurance policy