Imagine you’re driving home from work in your car. It’s a rainy night and suddenly… a car swerves into your lane and you have an accident. Once you get a hold of yourself, you thank the god and car insurance.

Car insurance policies have saved countless people from financial disasters after accidents. But in India, many first-time car owners are uncertain about what their policy covers. This can lead to them buying insurance that doesn’t fully protect them. Fret not!

In this blog, Aapka Policywala will explain different car insurance policies and what exactly they cover. By equipping yourself with this knowledge, you’ll be able to make informed decisions about your vehicle’s insurance.

Let’s start.

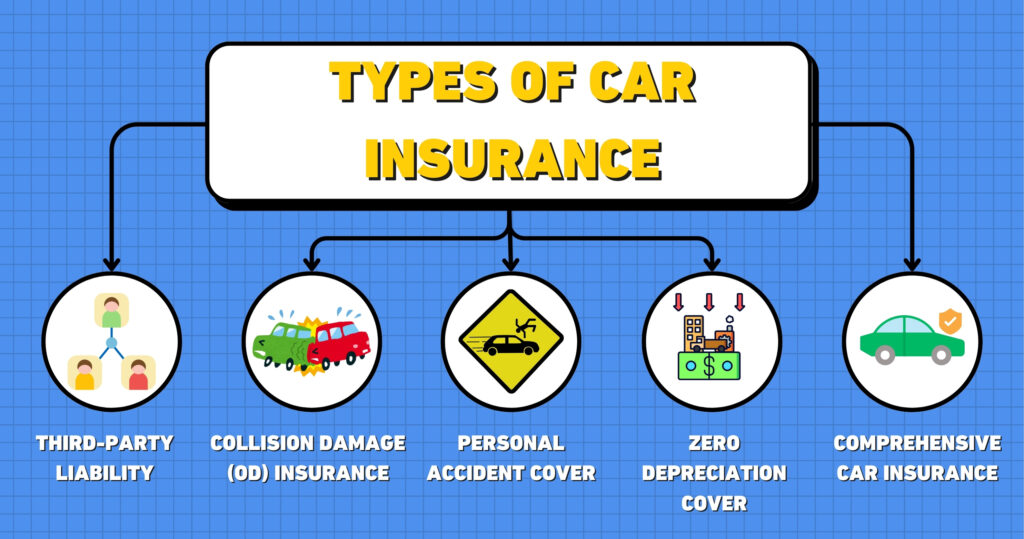

Types of Car Insurance and Coverage Offered

Okay, not all car insurance policies are created equal. Yes, you read it right! Just like there are different cars with different features, insurance offers various types of coverage to suit your specific needs. We bet this definitely made you go, “Wow! What are those types?”

Here, Aapka Policywala has broken down the most common car insurance options and what they cover. Choose the best fit for your car and driving habits:

1. Third-party Liability Only Insurance

The first type of car insurance that we’ll tell you about is third-party liability-only cover. You can think of it as a substratum. It’s the most basic yet crucial layer of protection. This policy covers your financial liability towards a third party involved in an accident you cause.

The following are the aspects that third-party liability-only insurance covers:

- Medical expenses: If someone in another vehicle gets hurt, it covers their medical bills.

- Property damage: Say you accidentally bumped into a parked motorcycle. This insurance will help you pay for its repairs.

- Death benefits: This policy provides compensation to the deceased’s family in the unfortunate case of a fatality.

Now you must be thinking, “What’s in for me?” Sadly, third-party liability insurance doesn’t cover any damage to your car. If you get into an accident, be prepared to spend your greenbacks to fix your vehicle. However, if you’re a first-time car owner or on a tight budget, this policy is a cost-effective way to meet the legal requirements of car insurance in India.

2. Collision Damage (OD) Insurance Cover

Time to move past the basics with Collision Damage (OD) policy. This insurance is just like a superhero protecting your vehicle. As different as chalk and cheese from third-party liability, OD cover presses forward by covering the car’s repair or replacement costs. Here’s what this type of insurance typically covers:

- Accidents: Regardless of who’s at fault, OD insurance covers the repair bills if your car gets damaged in a wreck.

- Theft: Stolen car? No need to lose sleep over it! You’ll receive the insured declared value (IDV). For those unaware, it’s the market value of your car at the time of theft minus depreciation.

- Natural disasters: Floods, earthquakes, and other natural disasters can put a kibosh on your vehicle. Collision damage insurance helps you get back on the road by accounting for the repair costs.

- Riots and vandalism: OD policy also does your part by covering repairs if your car is damaged due to riots or vandalism.

This type of insurance keeps your car financially protected against a wider range of risks. Unlike third-party coverage, you still have to pay for the damage caused to the third party’s vehicle.

Learn more about the best two-wheeler insurance online

3. Personal Accident Cover

Some car insurance types aren’t just about protecting your vehicle. They are also about safeguarding yourself i.e. drivers. This policy is one of them! Personal accident cover insurance, as the name suggests, provides financial support specifically for you – the car’s owner-driver – in case of an accident. We know what you’re thinking, “What’s the point of buying this type of policy?”

Okay, think of a situation where you met in a car accident and got injured badly. Medical bills can pile up quickly. Here, personal accident insurance will be your shield. It will reimburse medical expenses incurred due to the accident. It will also provide you compensation for:

- Permanent disability: If an accident leaves you with a permanent disability, this policy will offer a lump sum payout so that you can manage the financial impact.

- Death: God forbid, if you die in an accident, the policy will provide a lump sum amount to the nominee. Thus, helping them cope with the financial loss.

Remember, your well-being is important. A damaged car can be repaired. However, serious body injury can have long-lasting consequences. Coverage provided by this type of insurance guarantees you financial assistance during difficult times.

4. Zero Depreciation Cover

A lot of car insurance policies factor in depreciation when calculating claims. Meaning, you may receive less than the actual repair cost.

*Enters zero depreciation cover insurance*

It’s an add-on that eliminates depreciation on parts when your car needs repairs after an accident or theft. Intrinsically, you get the full amount for replacing parts. This ensures your car gets restored to its original condition without financial burden.

Buy or renew car insurance at Aapka Policywala!

5. Comprehensive Car Insurance

Finally, here comes the KING of car insurance coverage! Yes, you guessed it right – comprehensive car insurance. A policy that combines the benefits of the previous options we talked about. It offers the most extensive protection for your car, third-party vehicle, and you. Think of it as an all-in-one package.

Let’s talk about what exactly this type of car insurance covers:

- Complete third-party coverage: It comprises all the coverage that third-party policy offers.

- Damage to own car: Repairing damage cost to your insured car will be covered under this type of insurance policy.

- Personal accident cover: Received injuries during a car accident but have comprehensive car insurance? Consider the treatment cost covered!

- Theft: The current IDV of your vehicle will be remunerated to you in the event of theft.

- Fire: Similar to the car will be treated as a total loss if your car catches fire during an accident.

- Natural and man-made calamities: Your car got damaged in natural disasters like floods, earthquakes, landslides, rock slides, cyclones, or hurricanes. Or suffered at the hands of man-made calamities like acts of terrorism, vandalism, or riots? Either way, you will be compensated for the amount of damage caused to your four-wheeler.

- Add-ons: You can even extend the scope of car coverage by purchasing add-ons. A lot of useful add-ons are available across multiple insurance companies. Zero depreciation, roadside assistance, return to invoice, NCB protection, engine protection cover, and loss of personal belongings are some popular options.

What Do Different Car Insurance Policies Cover: Final Words

Above are different types of car insurance and the aspects that they cover. There’s no one-size-fits-all answer when it comes to choosing the best policy among these. Everything depends on your individual needs and budget. Consider factors like the value of your car, your driving habits, and the level of risk you’re comfortable with.

Aapka Policywala is here to help you navigate the world of vehicle insurance. Our PSOP agents can assess your car insurance needs and recommend you the most suitable policy. We offer a wide range of car insurance options that too from top insurance companies in India!

Get in touch with us today for a free quote and expert advice. Let us make sure you drive with confidence. Knowing you’re financially protected on the road.