Insurance is a crucial component of financial planning, providing individuals, families, or businesses with a safety measure against unexpected financial losses. The world of insurance in India has come quite a long way; there are now several policies available for each need. This is a complete guide that helps you understand the rudiments of insurance and types, its benefits, and how to select the right policy pertinent to your needs.

What is Insurance?

An insurance policy is essentially a contract involving two parties: the ‘insured’ and the ‘insurer.’ The insurer compensates for certain future losses of the insured in exchange for an agreed premium. The principle behind insurance is to protect people and businesses from financial loss due to various uncertain events or risks.

How does Insurance operate?

- Regular Premium Installments: The insured pays a specified amount of premium to the insurer.

- Period of insurance: It is that time when the insurance policy remains in operation and during which the insurer bears the risk as agreed upon in the contract.

- Claims: When the insured event occurs and causes loss or damage, the insured submits a claim to the insurance company.

- Settlement: The latter verifies the claim and pays compensation, if admissible, to the insured in accordance with the terms of the policy.

Types of Insurance in India

Insurance policies in India can broadly be classified into two parts: Life Insurance and General insurance.

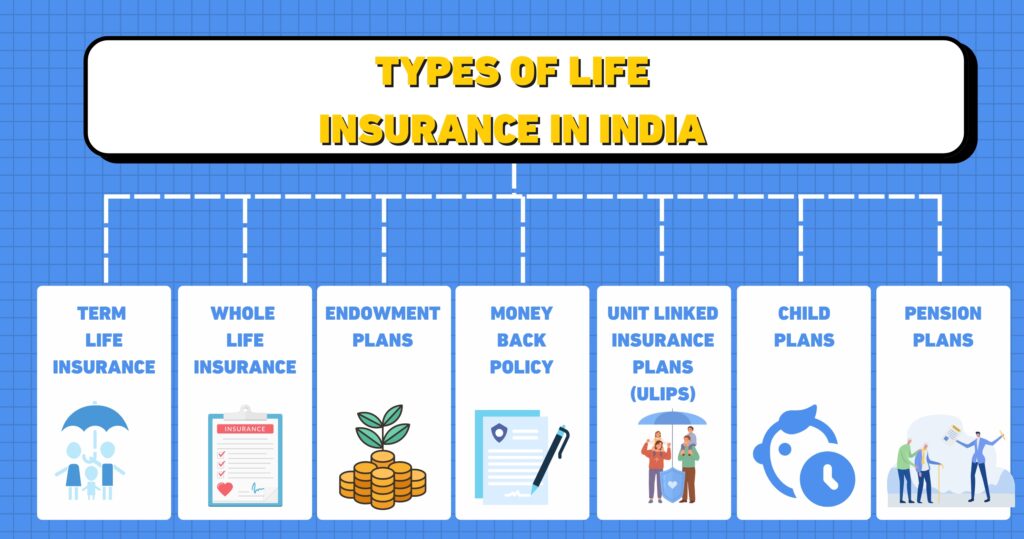

Life Insurance

The life insurance policies provide monetary security to the family of the insurer at the time of his or her demise. The major types of life insurances are as follows:

- Term Insurance: It only covers risk for a specified period. If the insured dies within this time, the nominee receives the death benefit.

- Endowment Plans: Combine risk cover with savings. In an endowment policy, the policyholder receives the total sum assured upon maturity, or the nominee receives the death benefit if the insured dies within the policy term.

- Whole Life Insurance: An insurance that covers the policyholder’s whole life, the benefit payable to the nominee in the event of death of the insured.

- Money Back Plans: The policies pay out a percentage of sum assured periodically during the term of the policy and, at the same time, pay a lump sum on maturity, with the death benefit on the death of the insured during the term.

General Insurance

General insurance policies cover non-life risks, such as health, property, and liability. Major kinds include:

- Health Insurance: This type of insurance is a typical product that aids in mitigating the medical expenses incurred by insured people due to illnesses or injuries. The products available are individual plans, family floater plans, critical illness plans, and senior citizen plans.

- Motor Insurance: According to the Motor Vehicle Act, every vehicle in India has motor insurance. It includes coverage for damages caused to the vehicle, third-party liability, and personal accident cover for the owner-driver.

- Home Insurance: The products provide coverage against damages caused to the structure and contents of a home by natural or man-made disasters.

- Travel Insurance: Insuring risks related to travels, such as medical urgencies, trip cancellations, and considered losses of baggage, amongst others.

- Personal Accident Insurance: This provides cover for death or disablement arising out of an accident.

Reasons for Purchasing Insurance Financial Protection:

- Cushions the financial distress to a person and his family at the time of any unexpected happening.

- Risk Management: Helps lessen the financial losses from such accidents or health problems and property damage.

- Peace of Mind: You feel secure and safe, which helps in lowering the level of stress and anxiety for you and your loved ones.

- Legal Requirement: Motor insurance is a must in India; it is a legal mandate to drive any vehicle on Indian roads.

- Investment and Savings: There are certain life insurance plans that come with savings and investment benefits which help you increase your wealth and plan your finances well.

How to Choose the Right Insurance Policy

- Evaluate Your Needs: Basically, your insurance needs will depend on your life stage, your financial goals, and your risk appetite.

- Compare policies using available online channels and tools that let you compare the number of insurance policies, premiums, and benefits.

- Understand the Policy Terms: Very clearly go through the fine print of the policy document, which details the coverage, the exclusions, the claim process, and other terms.

- Insurer’s Reputation: Consider an insurer’s claim settlement ratio, quality of customer service, and overall financial strength before buying policies.

- Reach Out to a Financial Advisor: Seek professional assistance in choosing the best insurance policy for you.

Some of the Most Common Insurance-related Jargons one should be familiar with

- Premium: It is the price one pays the insurance company for the coverage amount.

- Sum Assured: The amount that the insurance company promises to pay to the policyholder in case of a claim.

- Policy Term: It refers to the period for which your insurance policy offers its cover.

- Rider: An advantage that the base policy has toward enhanced coverage

- Deductible: The sum that must be borne by the policyholder before the insurer makes the settlement.,

- Exclusions: Conditions/ Situations expressly listed out for which the Policy doesn’t apply.

The Insurance Regulatory and Development Authority of India (IRDAI)

IRDAI is an insurance regulator in India. It works with objectives like protection of the interests of policyholders, regulation of the insurance industry, and ensuring orderly growth of the insurance business. The key functions would include:

The department sets rules and regulations for the insurance sector and assures compliance. Rules and regulations set by the insurance department work toward promoting growth of the insurance industry through its policy and initiative frameworks. Grievance redressal and ensuring that the policyholders are dealt with in a non-discriminatory manner.

Claim Process in India

Intimate the existence of the insured event to the insurance company at the earliest opportunity.

The documents should be submitted, including the claim form, policy document, proof of event, identity proof, etc.

Verification: The insurer will check the details mentioned in the claim and the proofs.

Approval and Settlement: For valid claims, the insurer will approve and settle the claim within the policy limits.

Tips to Manage Your Insurance Portfolio

- Periodic Review: Periodically review insurance policies to ensure they meet your intended purposes.

- Upgradation of Coverage: Upgradе your coverаge after life chаnges—mаrriаge, children, аnd purchаsing а new home, etc.

- Record Keeping: Keep аll files аnd documents relаted to insurаnces аrrаnged аnd within eаsy аccess.

- Nominee Details: Mаke sure thаt the nominee detаil is up to dаte to аvert аny trouble or inаdequаcy during.

- On-Time Premium Payments: Make premium payments in time to keep one’s policies live and avoid lapses of policies.

New Trends and Practices in the Indian Insurance Market

- Digital Transformation: The adoption of digital technologies in insurance operations, right from purchasing policy covers to settling claims, is leading to enhanced customer experience and operational efficiency.

- Customized products: Insurers are now more into offering tailor-made policies to fit the needs of customers.

- Usage-Based Insurance: In motor insurance in particular, there is a rise and popularity of usage-based policies, which are popularly known as pay-as-you-drive. These are driven by the behavior of driving and the use.

- Integration of Health and Wellness: The health insurance providers are integrating wellness programs by incentivizing healthy lifestyle choices.

- Microinsurance: It is tasked to provide cheap insurance solutions to low-income people. Microinsurance is already catching up with rural and other unserved areas.

The Future of Insurance in India

The insurance sector in India is bound to witness tremendous growth due to the rising awareness, technological advancement, and regulatory support.

- Innovation and Technology: How Indian Insurers are Preparing for Tomorrow will focus on areas like AI, ML, Blockchain, and how they enable changes in underwriting, fraud detection, and customer service.

- Financial Inclusion: This would imply the spread of insurance coverage to rural and financially underserved areas to ensure wider financial protection.

- Solvency: Designing products that provide a buffer against the risks transferred to the environment and society, and practicing sustainable and responsible insurance.

- Consumer Awareness: Enhancing consumer awareness levels for better appreciation of the requirement of insurance and taking empowered consumer decisions.

Insurance – FAQs

1. What is the difference between Life Insurance and General Insurance?

Life Insurance protects one from the financial burden of the risk of death, in that upon death, the family of the insured is made safe, otherwise. It may be in form of saving or investing. General Insurance, on the other hand, includes health, property, and liability, to mention but a few.

2. Why is Health Insurance necessary?

Health Insurance assumes importance because it pays your expenses arising out of sickness or injury. With soaring healthcare costs, you can be assured to get proper treatment without putting any unnecessary financial load on you.

3. Can I have several policies?

You can have as many policies to try and safeguard yourself from several risks. You may have a life insurance policy and health insurance and motor insurance and home insurance at the same time.

4. What is the premium calculated on the basis of?

A premium is arrived at after consideration of a variety of factors, including insurance type, sum assured, age, health, occupation, lifestyle of the policyholder, and tenure of the policy.

5. What does a claim settlement ratio mean?

The ratio of the number of claims actually settled by an insurance company against the total number of claims it received is known as a claim settlement ratio. A higher claim settlement ratio would mean a more reliable insurer.

6. What should I do if my claim is rejected?

After receiving a rejection of your claim, the first thing to do is to understand the grounds of such rejection from the insurer. If you feel the rejection is on harsh grounds, then you may first approach the grievance redressal cell of the insurer or get it resolved from the Insurance Ombudsman.

7. Are there tax benefits on insurance premiums?

Yes, insurance premiums paid on life insurance policies and health insurance policies are deductibles under sections 80C and 80D, respectively.

8. What is a no-claim bonus?

A no-claim bonus is the reduction in premium offered by the insurers in case the policyholder does not raise any claim during the policy term. This is common in the case of motor insurance and health insurance policies.

How AapkaPolicyWala.com Helps You Out

Today, the world is dynamic, and the insurance world is therefore a complicated landscape. At AapkaPolicywala.com, we are committed to making your experience simple and your decisions correct. Here are a few ways AapkaPolicyWala.com can help you in your journey with insurance:

1. Complete Comparison of Policies

Compare various insurance policies of reputed insurers in India available at AapkaPolicyWala Here are many things this facility helps you compare.

- Premium Rates: It will help you to compare the rate of premiums among insurance policies.

- Coverage Details: Get to know in detail the coverage of each policy: what is covered and what is not.

- Benefits and Features: Compare extra features or benefits of the policies, e.g., riders, bonuses, or discounts.

- Claim Settlement Ratios: Compare the claim settlement ratio of the policy amongst insurers.

This helps you make the most informed decision for a perfect insurance cover.

2. Professional Assistance with Right Advice

Selecting the best policy can be a very daunting task due to the high number of policies in the market. AapkaPolicyWala.com has a professional team of advisors to help you:

- Analyze Your Needs: Identify the nature and amount of insurance that will best suit your situation and your financial goals.

- Personalized Advice: Receive personalized advice that will be in alignment with what you specifically need and want.

- Professional Advice: Avail the experience and advice of professional insurance experts to answer all your questions and ensure unbiased advice.

3. Hassle Free Policy Procurement

Simple Online Application: Easily procure your insurance policies online with just a few clicks.

- Instant Quotes: Compare and select the best with on-the-spot quotes from multiple insurance companies.

- Secure Transactions: All transactions are safe and secure with high-end security systems online.

- Digital Documentation: Policy documents will be available online and not in papers, making it convenient to handle your insurance requirements.

4. Claims assistance and support

This is a very complicated process in a way, and in itself very stressful. AapkaPolicyWala.com offers end-to-end support in making claims in a bid to ensure a smooth, seamless process. Step-by-step guidance: Detailed filing of a claim and all documentation that would be required.

- Claim Submission: Raising a claim via the platform by ensuring all details are captured accurately.

- Follow up: Avail follow-up facility to check the progress on your claim and solution to any problem arising therein.

- Dispute Resolution: Help in resolving disputes, if any, related to your claim for its fair and timely settlement.

Conclusion

Insurance is an inherent part of financial planning and acts as a tool of security and peace of mind against various risks. Therefore, it becomes very pertinent for an Indian audience to know the fine very details of different products in the insurance segment: their benefits and how to select the right insurance cover. You can be assured of a financially secure future for both you and your kin if you stay informed and alert.

Be it your health, your family’s future, or your assets, it has given a sturdy framework for dealing with uncertainties and confidently living life through its hassles. Staying current with changing trends and practices in insurance will help leverage your insurance investments to the fullest.

5 Responses