Health takes a backseat in today’s fast-moving world amidst the hustle and bustle of life. However, the need to protect one’s health can never be underestimated. In such cases, health insurance becomes extremely vital by providing that security which, at times, may prove to be lifesaving during medical emergencies. The following article explains why health insurance is necessary for everybody, more so from the Indian perspective, by touching on all aspects ranging from financial security to access to quality healthcare and the changing healthcare scenario in India.

1. Understanding Health Insurance: A Primer

But before proceeding to its importance, let us get an idea of what health insurance really is. It basically serves as a contract between the individual and the provider of insurance services wherein the former’s medical expenses are covered by the latter in return for regular premium payments. Often, this encompasses hospitalization costs, pre and post-hospitalization expenses, and even, at times, outpatient consultations and medicines.

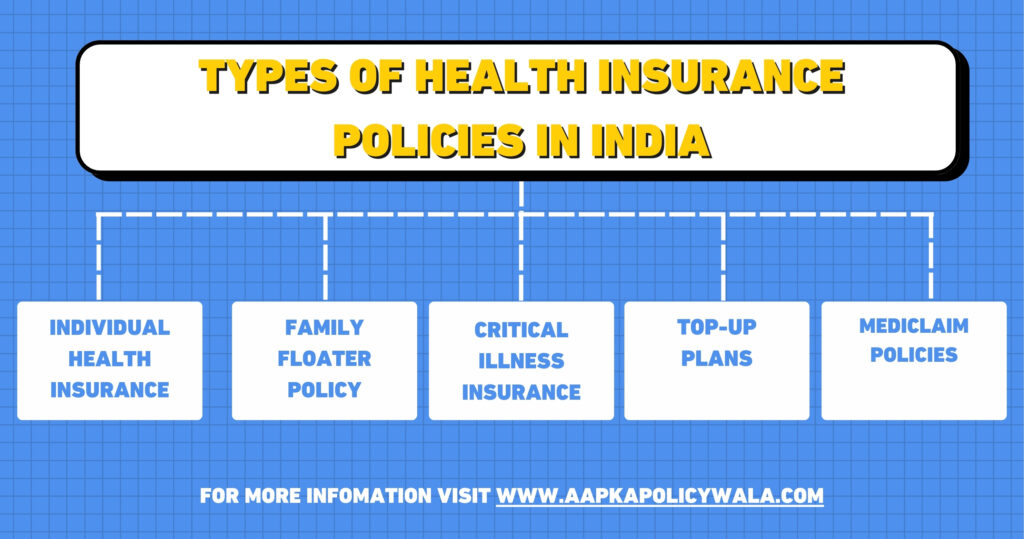

1.1 Types of Health Insurance Policies in India

In India, health insurance policies are sold in many forms. These include:

- Individual Health Insurance: This is a health insurance policy that pays for a single individual’s medical expenses incurred.

- Family Floater Policy: It provides overall protection to a family under a single sum insured.

- Critical Illness Insurance: This category of insurance plan provides coverage against certain specified illness of serious nature, like cancer and heart attack.

- Top-Up Plans: It provides additional coverage beyond the base policy normally associated with a higher deductible.

- Mediclaim Policies: They are traditional policies that are mainly designed to cover hospitalization expenses.

2. Financial Protection: Protecting Your Savings

The basic reason one should purchase health insurance is for financial protection. Expenses of medical treatment are now exorbitant and might dent the pocket in case the need actually arises due to some illness or accident.

2.1 The Escalating Cost of Healthcare

Healthcare costs in India are increasing. One day in a private hospital costs several thousands of rupees, and long treatments or surgeries cost lakhs. For instance, a major surgery like a heart bypass or cancer treatment may cost upwards of ₹5 lakhs. Without insurance, such expenses can deplete personal savings and put immense financial strain on families.

2.2 Health Insurance and Its Role in Financial Planning

Health insurance works like a shock absorber. In return for paying a small premium amount at regular intervals, you can rule out the chances of shelling out a hefty amount for your medical expenses. Thus, besides saving your savings from the financial shock, you and your family are financially protected during any period of illness.

3. Better Treatment Through Easy Access to Quality Healthcare

Health insurance is not absolutely about financial protection; it has a much more critical role: access to quality treatment.

3.1 Network Hospitals and Cashless Treatment

Most health insurance policies include a network of hospitals where one can avail of cashless treatment. You are basically not required to pay first and then wait for reimbursement. The insurer will directly settle the bill with the hospital. This facility is quite important in lessening the stress and financial load associated with medical emergencies.

3.2 Enhanced Access to Specialists and Newer Treatments

It will also help you avail services in reputed hospitals and see top-rated specialists. Advanced treatments and surgeries for which innumerable insurance plans can provide coverage otherwise may prove unaffordable. This access to top-notch medical care may impact recovery and health outcomes considerably.

4. Growing Need for Healthcare: Changing Demographics of India

The demographic profile of India is changing—the increasing burden of lifestyle diseases and an aging population. These factors make health insurance all the more relevant.

4.1 The Growing Burden of Lifestyle Diseases

Changing modern lifestyles have resulted in a variety of chronic conditions like diabetes, hypertension, and cardiac disorders. These require constant monitoring and, at times, expensive treatment. Health insurance can help in effectively managing these expenses and enabling continuous care without financial worry.

4.2 The Greying Population and Higher Needs for Health care

India is greying fast. And with age, the needs for healthcare rise as also the cost of treatment. It is in such circumstances that one needs to have health insurance to offset the medical costs of aging and to ensure the reasonable care that senior citizens need, without the barricades of expenses.

5. Government Initiatives and Policies: Encouraging Health Insurance

The government of India has also realized the importance of health insurance and has come up with various plans to promote this sector.

5.1 Pradhan Mantri Jan Arogya Yojana (PMJAY)

PMJAY, more popularly known as Ayushman Bharat, aims at protecting the economically weaker sections from financial risks. ₹5 lakhs of coverage is provided to every family per year for secondary and tertiary care hospitalization under the scheme. It exemplifies the commitment of the government toward the goals of accessibility and affordability with respect to health care for all.

5.2 Tax Benefits under Section 80D

Health insurance premiums are eligible for tax benefits under Section 80D of the Income Tax Act. In the case of an individual, there is a deduction of ₹25,000 paid as premium for self, spouse, and children, and another ₹25,000 for the premium paid for parents. It becomes ₹50,000 in the case of senior citizens. This incentive would bring down the effective cost of health insurance and encourage more people to get covered.

6. How to Choose the Right Health Insurance Policy

Choosing the right health insurance policy needs attention to various factors.

6.1 Assessing Your Needs

Calculate the needed coverage based on your health conditions, family size, and lifestyle. Check for the sum insured, coverage of pre-existing diseases, maternity benefits, and limits on room rent.

6.2 Comparing Plans

Use the available comparison tools and insurance advisors’ advice to compare plans. Compare benefits, exclusions, network hospitals, and costs of premiums.

6.3 Fine Print

Always go through policy documents carefully. Understand the terms and conditions under which you buy an insurance product. Know the waiting periods, sub-limits, claim settlement procedures, etc.

7. Stepping Beyond Common Myths and Misconceptions

There are a number of myths associated with purchasing health insurance that make people reluctant to buy a policy. These can be addressed through the clarification of these misconceptions.

7.1 “Health Insurance is Expensive”

This might be true in some cases, but there are also numerous cheap ones available out there. Moreover, health insurance typically costs only a few percent compared to what you might end up spending on your health care.

7.2 “I’m Young and Fit, I Don’t Need Insurance”

Health can take anyone by surprise at any age. With health insurance, you will always be prepared for those nasty surprises that often come your way, no matter how fit you might be.

7.3 “Insurance Won’t Pay for Pre-Existing Conditions”

The good news is, most health insurance plans do cover pre-existing conditions, but of course, with a waiting period. It’s always necessary to be honest when declaring your medical history and ensure that you get adequate coverage.

8. How Health Insurance Affects Mental Health

Health insurance does not just help in the physical health of an individual; it has much to do with mental wellbeing, too. Given that financial stress can be a major burdening on mental health, no doubt it is, having health insurance alleviates this burden.

8.1 Relieves from Financial Stress

Unplanned expenditure on medical treatment could put a person under massive financial stress and anxiety. Health insurance gives the safety bell, ridding one of worries over sudden medical costs, hence allowing a person to focus on recovery and health without the nagging fear of financial stress.

8.2. Accessing Mental Health Services

Many health insurance plans now offer mental health services. In a country like India, where mental health is fast finding acceptance, this could prove to be very beneficial indeed. Easy access to mental health support significantly enhances the quality of life and overall health outcomes.

9. Role of Technology in Health Insurance

Currently, health insurance is increasingly more accessible and user-friendly due to technology.

9.1 Digital Health Insurance Platforms

Online platforms and mobile applications have made purchasing and administering health insurance much easier. One can compare, buy, claim, and track policy details easily from the comfort of one’s home. Then, of course, there is the convenience offered by technology that more people can now access and administer their health insurance effectively.

9.2 Telemedicine and Health Insurance

Telemedicine has gained popularity, especially in the last couple of years. Many medical insurance providers provide coverage to teleconsultations that can be quite convenient and cost-effective to get some good advice. Coverage stretches health care services more into remote or otherwise underserved areas.

10. Health Insurance and Preventive Healthcare

Prevention is part of health care and can be a focus of health insurance policies.

10.1 Preventive Services

Many health insurance plans already cover many preventive services, including vaccinations, screenings, and regular health checkups. Health insurance makes treatments more effective and less expensive by allowing for early detection of diseases through preventive care.

10.2 Wellness Programs and Incentives

Some offer wellness programs, with incentives for keeping a healthy lifestyle. Examples of this may include premium discounts if one participates in certain health and fitness activities, maintains regular checkups, or sustains a healthy weight. Such programs give the person motivation to be responsible in maintaining better health.

11. Knowing What’s Excluded and Limited in the Policy

Even though health insurance has many advantages, some limitations and exclusions are also enacted.

11.1 Common Exclusions

These might include clauses that limit coverage of pre-existing conditions for the first few years, cosmetic procedures, and some high-cost treatments. Knowing them helps keep expectations at bay and plans additional coverage, if required.

11.2 Sub-Limits and Co-Payments

Policies may include sub-limits on part of the expenses, like room rent or specific treatments, and co-payment clauses where a percentage of medical costs is to be borne by the insured. This kind of knowledge will help people select appropriate policies for them and not get surprised over some terms while making claims.

12. The Future of Health Insurance in India

The dynamic nature of the health insurance scene in India arises because of changing needs and advancing technology.

12.1 Emerging Trends

- Customised products: With the basic needs differing for a senior citizen, a young family, or a patient with chronic conditions, insurers are coming up with more customized products.More focus on

- Wellness: Wellness and preventive care will form a larger part of health insurance policies.

- Innovative Technology: Advanced technologies like AI and data analytics are evolving in processing claims and customer service.

12.2 The Need for Greater Awareness

Despite the progress, greater awareness still needs to be etched regarding health insurance. So, educating the public about the benefits of health insurance, followed by detailed policy knowledge and navigating insurance landscapes, can make for more informed decisions and broader coverage.

13. Tips for Maximizing Your Health Insurance Benefits

Here are some tips that can help one get the most from his/her health insurance policy:

13.1 Review Your Policy Regularly

Make sure to periodically review your health insurance policy to update and change the provisions that no longer apply to your present needs. Your needs will change according to your health requirements and changes in your family.

13.2 Know the Claim Process

Familiarize yourself with the claim process to avoid glitches and delays. Knowing the documentation required and the steps involved in filing a claim can help the process run more smoothly and expedite your reimbursement.

13.3 Avail of Preventive Care Benefits

Avail of preventive care benefits that are part of your policy. A periodic check-up, screening, and vaccinations can pick up a disease before it reaches a serious level or even prevent it. This might save future medical bills on diagnosis and treatment.

Health insurance forms an important component in personal and family financial planning. In the Indian context, with rapidly rising medical expenses and changing healthcare needs, adequate health insurance is thus more important than ever. It gives one financial protection, access to quality healthcare, and supports well-being as a whole.

An understanding of the need for health insurance, choosing the right policy, and enjoying its benefits will go a long way in safeguarding people’s health and financial stability. The ability to understand and make relevant decisions regarding health insurance will thus turn into an imperative part of building a much healthier and more secure financial future.

Investing in health insurance is not just a financial decision; it’s also a crucial step toward ensuring a healthy and peaceful future for you and your family members.

AapkaPolicywala will help you with an easy way out to get the right health insurance policy for you and your loved ones. It provides a friendly user platform that assists in comparing various health insurance plans, understanding the coverage benefits, and selecting one per your requirements. With professional guidance and several tools at your command, AapkaPolicywala will ensure that you make informed choices, help yourself save on premiums, and settle down for overall coverage. Whether you need personalized advice or assistance with understanding the fine print of any policy, AapkaPolicywala.com will partner with you to provide peace of mind through the right health insurance solutions.

4 Responses